The US is beefing up its battery materials supply chain C&EN.

New projects focus on key intermediate materials for lithium-ion batteries.

he effort to build a US-based supply chain for lithium-ion batteries used in electric vehicles is gaining steam. The US Department of Energy has announced over $3 billion in funding to support domestic manufacturing of battery materials, and a number of companies have recently stated plans to expand in the US.

The expansion projects are focused on a handful of materials that make up most of a battery’s value. The most recent initiatives involve additives to improve battery performance, separators that divide the positive and negative ends of a battery, and negatively charged anode materials.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Key materials also include cathode materials, at the positive side of a battery, and electrolytes, which allow ions to flow from one end to another.

The carbon black maker Orion Engineered Carbons says it plans to spend more than $120 million to build the first US plant for an acetylene-based conductive additive. This powdered carbon material is added to lithium-ion batteries to increase conductivity and extend life.

The plant will be in Texas and is expected to start production in 2024. Orion operates a similar plant in France.

Entek, which has produced separators for lead-acid car batteries since 1984, is expanding its lithium-ion battery separator business. The firm plans to produce enough separator material for 1.4 million electric vehicles by 2027.

Its initial expansion, at its factory in Nevada, will increase capacity for ceramic-coated separators, a durable alternative that can make batteries that are less likely to catch on fire.

As they pursue the battery market, companies like Entek are looking to gain a technological advantage to differentiate themselves from competitors in other countries.

James Frith, a principal with the venture capital firm Volta Energy Technologies, said:

It’s not just about replicating an existing technology from overseas.

“There’s also an element of helping support new and improved technology.”

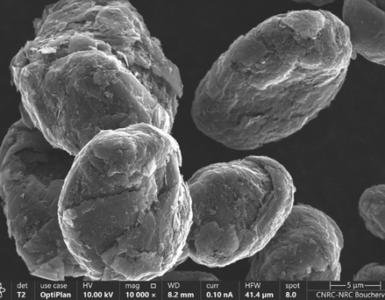

Likewise, Group14 Technologies and Sila Nanotechnologies recently announced plans to expand production of silicon-based anode materials, which they claim will outperform current graphite materials.

Group14 opened a 2,500 m2 anode materials factory near Seattle last year and has now raised $400 million to build a second US factory. Sila says it has purchased a 55,000 m2 factory in Moses Lake, Washington, where it will make silicon anode materials.

The Sila facility is across the street from REC Silicon, a company that provides polysilicon and silicon gas for solar and electronics applications. REC worked with Group14 to build a pilot plant before the firm built the Seattle factory.

REC mothballed its Moses Lake operation in 2019, after tariffs made it difficult to sell silicon products in China. The company now says it may restart production to support the adoption of silicon-based anode materials.

REC is not the only company turning toward batteries as the industry heats up. Andrew Wang, a PhD candidate at the University of Oxford studying lithium-ion batteries who writes for the industry newsletter Intercalation Station, says companies that previously worked on lower-value commodities are now interested in producing battery materials.

Andrew Wang, a PhD candidate at the University of Oxford, said:

Petrochemical companies that were making graphite electrodes for steel production, now they can make high-value carbon anodes for lithium-ion batteries.

Phillips 66’s plan to do that with the Australian anode maker Novonix is one example, he says.

Although the nascent US battery industry will need increased supplies of a number of materials, some analysts warn that lithium will be the most serious bottleneck in the production of electric vehicle batteries.

Albemarle is now the only large-volume lithium producer in the US. The company plans to double US capacity over the next several years, and other firms have plans to extract lithium in Nevada, Arkansas, and California.

Those projects are still in the early stages of development, however, and the US battery industry will rely on imports until local lithium production increases.

READ the latest Batteries News shaping the battery market

The US is beefing up its battery materials supply chain, May 12, 2022