Cobalt Market Report – Electric Vehicles become major driving force for cobalt demand growth in 2021.

Securing access to responsibly produced raw materials is key to ensuring the implementation of the Paris Accords. Cobalt is a critical part of the solution: it is crucial for ensuring durability and safety of lithium-ion batteries, it is integral to sustainable technologies such as energy storage and is infinitely recyclable.

These virtues make cobalt a true enabler of the green economy and technological innovation of battery technologies.

Nevertheless, the effects of the pandemic continue to place global supply chains under strain and the war in Ukraine is expected to have far reaching and long-lasting impacts on commodity markets and energy in particular.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

The publication of the Cobalt Institute’s “Cobalt Market Report” – the most comprehensive market overview to date – provides an in-depth analysis of the trends driving the demand for this unique commodity.

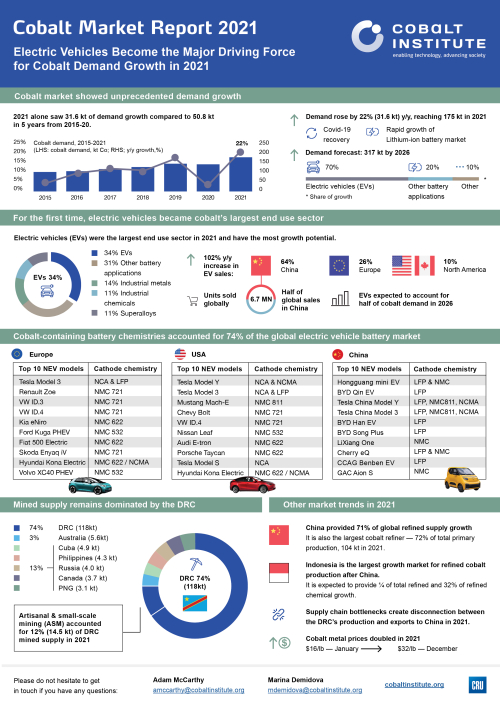

In 2021, the cobalt market showed unprecedented annual demand growth of 22%. This was largely due to the rapid growth of the lithium-ion battery market and a strong sales of electric vehicles.

As electric vehicles continue to revolutionise the way we travel, cobalt-containing batteries are a technology of choice for many car manufacturers in all of the major automotive markets of China, Europe and North America.

Whilst I am optimistic about the future of cobalt, the industry faces a number of challenges to ensure its ongoing relevance in future technology. The debate around the substitution of this unique commodity can only be overcome through a continued focus on embedding transparent and responsible business practices across the supply chain.

The Cobalt Institute publishes this report to make the supply chain data accessible to everyone and to help underpin a broader approach to transparency.

After remaining flat during the first stages of the Covid-19 pandemic, the market rebounded in 2021 growing 22% year-on-year (y/y) to 175 kt. Demand rose by 32 kt in 2021 alone compared to 51 kt in the 5 years from 2015-20. Growth was led by lithium-ion battery applications, accounting for 63% of annual demand and 85% of y/y growth.

For the very first time in 2021, cobalt demand from electric vehicles (EVs) overtook other battery applications to become the largest end use sector at 34% of demand, totalling 59 kt. This was supported by EV sales doubling over 2020 levels, with China accounting for more than half of global sales and 64% of y/y growth.

The EV sector uses a combination of lithium-ion battery chemistries with cobalt-containing cathodes maintaining the largest share due to their superior energy density and performance – cobalt is particularly important for stability and safety. In 2021, 74% of global light duty EV battery demand was for nickel- and cobalt-based chemistries compared to 25% for lithium iron phosphate (LFP).

Supply also returned to growth in 2021, with mine supply rising 12% y/y to 160 kt, after falling in 2020. The Democratic Republic of the Congo (DRC) produced 74% of mined cobalt in 2021 and accounted for 87% (15 kt) of annual growth.

Output from the artisanal and small scale mining (ASM) sector is estimated to have increased to 14.5 kt in 2021, 12% of the DRC’s total supply. Primary refined supply increased 14% y/y to 144 kt; China remains the largest refined cobalt producer, providing around 70% of both 2021 refined supply and y/y growth. Finland, Indonesia and Madagascar combined provided 27% of refined supply growth in 2021.

A variety of factors constrained logistics and supply chains in 2020 and 2021, particularly impacting cobalt hydroxide exports from the DRC to China. As a result, increased mined output from the DRC has not translated to increased exports to China.

Tight cobalt hydroxide supply lifted payables substantially from early 2021 and they remained close to 90% for most of the year, impacting the wider cobalt market. High payables put pressure on the margins of metal producers in China resulting in a 35% y/y fall in production in 2021.

Alongside weaker European metal prices, China imported larger volumes of cobalt metal to supplement constrained hydroxide imports, with imports averaging 280% higher y/y in the period from 2020 Q3 to 2021 Q2.

Robust market performance and ongoing tight conditions were highlighted by cobalt’s price growth in 2021 – European metal prices doubled through the year from $16/lb in January to $32/lb by the end of the year.

Due to relative market weakness, European prices averaged $2.5 below Chinese metal in 2021, with the is count persisting since mid-2020. Cobalt sulphate prices also maintained a premium over metal, averaging $3.6/lb, due to very strong chemical demand growth from the lithium-ion battery sector.

Robust market performance and ongoing tight conditions were highlighted by cobalt’s price growth in 2021 – European metal prices doubled through the year from $16/lb in January to $32/lb by the end of the year. Due to relative market weakness, European prices averaged $2.5 below Chinese metal in 2021, with the discount persisting since mid-2020. Cobalt sulphate prices also maintained a premium over metal, averaging $3.6/lb, due to very strong chemical demand growth from the lithium-ion battery sector.

Looking ahead, cobalt demand is expected to continue rising rapidly as the EV transition gains pace –demand is forecast to approach 320 kt in the next 5 years from 175 kt in 2021; 70% of growth will come from the EV sector. Supply will keep pace with demand in the short term, however supply chain bottlenecks remain a key risk.

Freight routes were anticipated to begin to normalise from the second half of 2022, but this will likely be delayed due to impacts from the war in Ukraine and Covid-19 lockdowns in China.

From 2024, the market is forecast to shift back into a deficit as supply growth fails to keep pace with demand. Prices will remain elevated to incentivise further investment and prevent wide deficits developing.

READ the latest Batteries News shaping the battery market

TRANSPARENT AND ACCESSIBLE INFORMATION ON THE COBALT SUPPLY CHAIN FOR EVERYONE, May 18, 2022