CALSTART & Yunev release commercial vehicle battery cost assessment report.

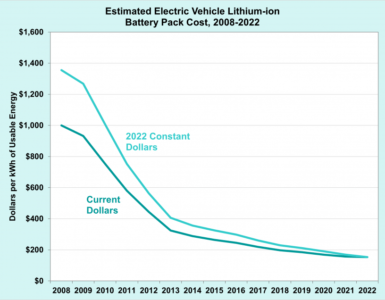

Those who have spent their entire careers in the automotive industry recognize the exceptional transformation taking place in the electric vehicle (EV) market. Reports of new start-ups in the EV space, or new EV ventures among established original equipment manufacturers (OEMs) and Tier 1 suppliers, arrive at an almost daily pace. China launches one new battery megafactory each week, while Europe and the United States make a concerted attempt to play catch-up.

Established carmakers in North America are engaged in a make-or-break strategic planning exercise to pinpoint when EVs actually cross the chasm and begin capturing early majority customers. Yet, once that milestone is reached, will it be too late for the incumbents to launch enough new products to prevent losing significant market share?

Established carmakers in North America are engaged in a make-or-break strategic planning exercise to pinpoint when EVs actually cross the chasm and begin capturing early majority customers.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

These questions are only a few of the backdrop inquiries and dilemmas facing commercial vehicle OEMs and their Tier 1 suppliers in North America. As this report will discuss, the stakes are even higher for commercial vehicle OEMs due to their much lower volumes and scale, which make the battery sourcing challenge that much greater.

Furthermore, the incumbent truck OEMs face a growing number of well-funded, talent-driven start-ups that are not constrained by the traditional product and sales channel approaches often followed by the more established players. Some of these newcomers, like Tesla and BYD, have access to some of the largest scale (and lowest cost) batteries in the passenger car EV world, which gives them a competitive advantage on the single largest cost element of the EV.

For the first time in recent history, start-ups may also have an advantage in terms of how they price their EVs by leveraging shareholder capacity to subsidize EV technology pricing to secure early market share positions. Will regulators take these market discontinuities into consideration when revising incentive policies for the future? Or will today’s playing field be tilted even further in the

direction of industry newcomers and start-ups?

Finally, there is reason to believe that today’s battery industry structure and pricing levels are not fully understood when it comes to the North American commercial vehicle OEM and Tier 1 segments. This paper seeks to provide a substantive description and discussion of today’s marketplace and provide directional pricing guidance on today’s battery cost structure and where it may go in the coming two to five years.

READ the latest Batteries News shaping the battery market

Read the full report following the link below.

Commercial Vehicle Battery Cost Assessment – Industry Report, June 2021