Tesla is considering a bid for battery metals miner Sigma Lithium.

Sigma Lithium Corp. soared in Canadian trading on news that Tesla Inc. has been weighing a takeover of the battery-metals miner amid rampant demand for the materials needed to power electric vehicles.

The company’s shares rose as much as 22%, their biggest intraday jump since May 2021. The stock was up 16% at 9:47 a.m. in Toronto, giving the company a market value of C$4.8 billion ($3.6 billion).

Tesla, the EV maker run by Elon Musk, has been speaking with potential advisers about a bid for Sigma Lithium, Bloomberg News reported late Friday. Sigma Lithium is one of multiple mining options Tesla is exploring as it mulls its own refining, a person with knowledge of the matter said, asking not to be identified discussing confidential information.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Sigma Lithium’s biggest shareholder has been exploring a potential sale of the company and gauging interest from miners and carmakers, people familiar with the matter said. Its biggest investor, holding 46%, is A10 Investimentos, a Brazilian private equity fund that Sigma Co-Chief Executive Officer Ana Cabral-Gardner helped establish. Co-CEO Calvyn Gardner, also owns part of the miner.

Deliberations are in the early stages and may not lead to a transaction, according to the people. Potential suitors may hesitate to bid after shares tripled in the last 12 months and on high price expectations by the owners, the people said. Sigma’s owners could also wait to develop the company’s main project further before seeking an exit, according to the people.

- Read more: Tesla’s Lithium Supplies in Danger as Rivals Make Mining Deals

Elon Musk, representatives for Tesla did not respond to requests for comment. Sigma Lithium’s Cabral-Gardner declined to comment on “rumors.”

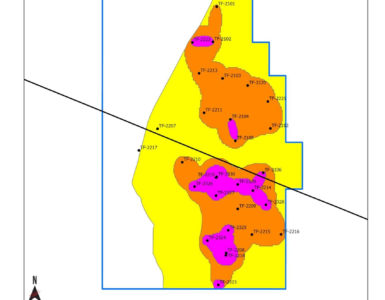

The company is developing a large lithium rock deposit in Brazil known as Grota do Cirilo. The company said in December that it’s considering nearly tripling lithium production at the project in 2024 after survey revealed mineral reserves 63% higher than previously thought.

Sigma Lithium’s shares have been rising along with surging lithium prices. Demand for the silvery white metal, which is key to making EV batteries, is greatly outstripping supply amid the push to electrify transportation in a shift away from fossil fuels.

- Read more: Sigma Lithium Fires Up Brazil’s First Plant for the EV Metal

Sigma Lithium may also attract interest from large miners as well as customers of the metal. Rio Tinto Group, the world’s second biggest mining company, is actively looking for lithium acquisitions, but isn’t currently interested in Sigma Lithium because of the high asking price, one of the people said.

The company has already signed supply deals with LG Energy Solution and Japanese trading house Mitsui & Co.

Tesla Is Considering a Bid for Battery Metals Miner, February 21, 2023