Rock Tech Lithium completes Pre-Feasibility Study for its Georgia Lake Project.

Rock Tech Lithium Inc. (TSXV: RCK) (OTCQX: RCKTF) (FWB: RJIB) (WKN: A1XF0V) (the “Company” or “Rock Tech”) announce the results of a Pre-Feasibility Study (“PFS”) completed for its 100%-owned Georgia Lake spodumene project located in the Thunder Bay Mining District of Ontario, Canada (the “Georgia Lake Project”).

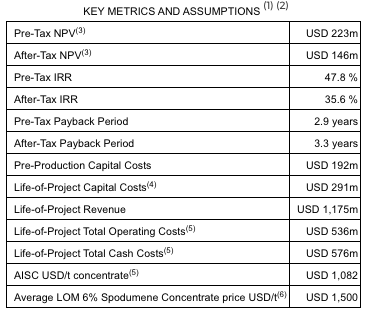

The PFS strengthens and further substantiates previous engineering studies and supports an open pit and underground mine operation and the construction of a 1,000,000 tonne-per-annum spodumene concentrator. The positive results indicate a pre-tax internal return rate of 47.8% and a pre-tax net present value of US-Dollars 223 million for the Georgia Lake Project.

They also support Rock Tech’s decision to further deepen and shape the vertically integrated strategy connecting its mining, concentration, and conversion operations. The Company is also pleased to announce an initial Mineral Reserve and updated Mineral Resource estimates for the Georgia Lake Project.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

PRE-FEASIBILITY STUDY HIGHLIGHTS

- Estimated pre-tax net present value at an 8% discount rate (“NPV”) of USD 223 million at an average life of mine (“LOM”) price of USD 1,500/t, 6% spodumene concentrate (“SC6”).

- Estimated pre-tax internal rate of return (“IRR”) of 47.8% at an average LOM price of USD 1,500/t, SC6.

- LOM of 9 years, with low-cost open pit mining for the first 4 years and underground mining for the last 5 years.

- Pre-tax payback of 2.9 years.

- Update to Mineral Resource estimate: Total Indicated Mineral Resources of 10.6mt at grading 0.88% Li2O and total Inferred Mineral Resources of 4.2mt at grading of 1.00% Li2O.

- Declaration of Mineral Reserves: Total Probable Mineral Reserves of 7.33mt at grading of 0.82% Li2O.

- Pre-production costs estimated at USD 192.2 million and sustaining capital costs of USD 98.5 million (including closure costs).

- Average annual spodumene concentrate production of approximately 100,000 t of SC6.

- Total LOM average cash costs of USD 719/t concentrate.

The objective of the PFS was to assess the technical and economic viability of achieving spodumene concentrate production at the Georgia Lake Project. The PFS evaluated the construction and operation of a 1,000,000 tonne-per-annum concentrator (the “Georgia Lake Concentrator”) with open pit and underground mining operations over a 9-year LOM.

The Company is pleased that the positive results of the PFS support the viability of lithium mining activities and the concentration of spodumene at the Georgia Lake Project.

The economics associated with the construction of a lithium hydroxide converter and refinery facility (a “Converter”) at the Georgia Lake Project were not considered as part of the PFS.

Accordingly, the results of the PFS may not be directly comparable to the results of the 2021 PEA (as defined below), which contemplated the construction and operation of an integrated 15,000 tonne-per-annum Converter for refining a portion of the production from the Georgia Lake Project.

The Company continues to evaluate refining opportunities for future production from the Georgia Lake Project in light of industry and global socio-economic factors and competencies developed in connection with the ongoing development of the Company’s proposed Converter in Guben, Germany.

Such refining opportunities include utilizing a vertically integrated strategy for the Georgia Lake Project, whereby future production from the Georgia Lake Project is refined at the proposed Converter in Guben or a Company owned-and-operated Converter in North America or selling such production to existing third-party refiners.

The metallurgical testwork completed on sample feedstock from the Georgia Lake Project positively demonstrates the suitability of the spodumene concentrate for conversion into battery-grade lithium hydroxide.

Dirk Harbecke, Rock Tech’s CEO, commented on the encouraging developments:

These results support the integration of Georgia Lake with the downstream conversion industry, where we have been building strong partnerships and extensive know-how.

“The encouraging results also demonstrate that we are well positioned to explore potential fields of collaboration in the North American and European EV supply chain”.

The PFS and Mineral Reserve and Resource estimates have further increased the confidence level of bringing the Georgia Lake Project towards feasibility level, which will provide the basis for a construction decision. The Company intends to undertake a feasibility study for the Georgia Lake Project as part of its efforts to optimize and advance the Georgia Lake Project.

These efforts are expected to include upgrading the Mineral Resource and Mineral Reserve estimates through exploration drilling, optimizing mining operations with the opportunity to become owner-operated, and enhancing infrastructure detail through support from the Company’s indigenous partners to reduce capital costs and increase operational efficiency.

SUMMARY OF PFS RESULTS

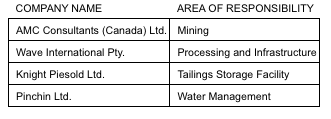

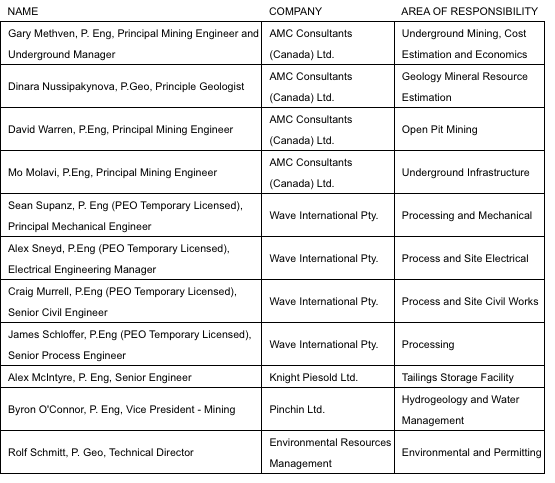

The PFS and Mineral Reserve and Mineral Resource estimates have been prepared in accordance with the National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by AMC Consulting (Canada) Ltd. (“AMC”) with specialist contributions from Wave International Pty (“Wave”), Knight Piesold Consulting (“KP”), Pinchin Ltd. (“Pinchin”), Environmental Resources Management (“ERM”), and Environmental Applications Group (“EAG”).

The PFS evaluates the planned production of spodumene concentrate from an average of 2,800 tonne-per-day (“tpd”) open pit and underground operation, with a process plant that will include crushing, grinding, density media separation (DMS) and flotation, estimated to produce a combined 6% Li2O grade spodumene concentrate.

The PFS incorporates the recent results from the Company’s drilling program at the Georgia Lake Project, as well as recent metallurgical test work to determine key process criteria and operational recovery.

Metallurgical testing programs were undertaken at commercial laboratories SGS Canada Inc. (“SGS”) and Nagrom Mineral Processors (“Nagrom”) simulating and improving the process flowsheet to maximize ore grade and recovery.

KEY METRICS

The PFS estimated a pre-tax NPV of the Georgia Lake Project of USD 223 million compared to the USD 289 million pre-tax NPV estimated in the Company’s technical report titled, “Preliminary Economic Assessment for an Integrated Lithium Hydroxide Operation from the Georgia Lake Lithium Project, Northwest Ontario, Canada” (the “2021 PEA”), while the PFS estimates an after tax NPV of USD 146 million compared to the USD 230 million estimated in the 2021 PEA.

Additionally, the PFS estimates an IRR of 48% and 36%, pre-tax and after-tax respectively, compared to 22% and 20% estimated in the 2021 PEA.

Differences in key metrics between the 2022 PFS and the 2021 PEA are primarily attributable to the exclusion of an integrated Converter in the PFS, an increased level of confidence in the engineering details, a change in the mineral resource categories and updated cost estimates based on 2022 market conditions.

Additional differences include a more complex recovery flowsheet, which includes the process of DMS; the addition of an on-site camp and subsequent accommodation service; and a closure plan that is more closely aligned with similar operations.

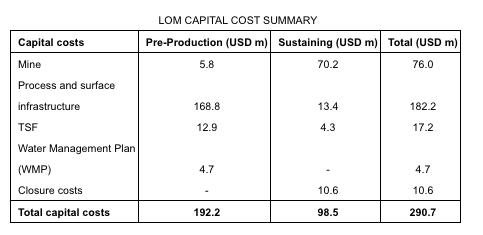

CAPITAL COST ESTIMATES

The mine site project covered in the PFS is based on the planned construction of a green field facility having an estimated nominal annual feed of 1 Mtpa for open pit and underground mining. The capital and operating cost estimates were completed by the following parties:

The capital cost estimate for this project is considered to an expected accuracy level of +25% / -25%, carrying a contingency of 20%.

The capital costs for the LOM are estimated to be a total of USD 290.7 million, which consist of pre-production capital costs of USD 192.2 million and sustaining capital costs of USD 98.5 million, including closure costs of USD 10.6 million. The LOM capital costs summary and its distribution by area is shown in the table below.

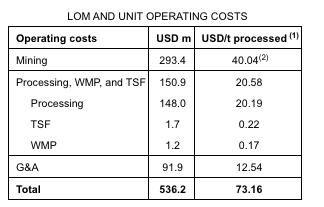

OPERATING COST ESTIMATES

The average unit operating cost over the LOM are estimated at USD 73.16/t processed. The unit operating costs include contractor quoted costs for open pit of USD 4.45/t open pit mined material and underground mining of USD 50.78/t underground ore mined, which equates to an estimated weighted average LOM mining cost of USD 40.04/t processed.

The mineral processing costs are USD 20.58/t processed and the general and administration (G&A) costs are USD 12.54/t processed. Operating cost estimates for the project are summarized below.

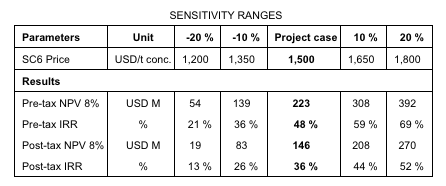

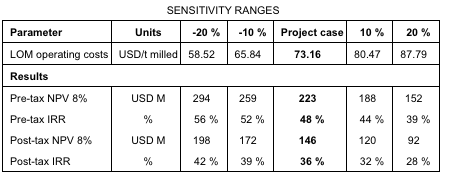

KEY ASSUMPTIONS AND SENSITIVITY ANALYSIS

The discount rate for financial analysis is 8%. The weighted average price of spodumene concentrate is USD 1,500(1) per tonne over the life of mine, reducing from a peak price of USD 2,722 per tonne in 2024. The following exchange rates were considered: C$1.00 = US$0.77, C$1.00 = A$1.10; C$1.00 = €0.73.

As part of the PFS, a sensitivity analysis was conducted on the Project’s NPV and IRR for key variables, which include spodumene concentrate price, capital costs, and operating costs. Using the base case as a reference, the key variables were changed between +/-20% at 10% intervals while holding other variables constant.

The Project is most sensitive to spodumene concentrate prices, capital, and operating costs. Spodumene concentrate price, capital costs and operating cost sensitivities are presented in the tables below.

MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

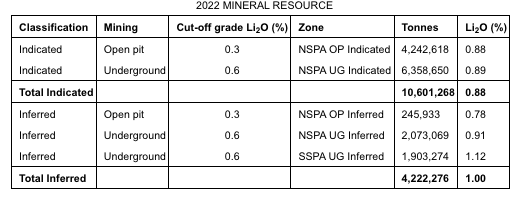

The updated Mineral Resource estimate of the Georgia Lake Property outlined 10.60 million tonnes (mt) of Indicated Mineral Resource at a grade of 0.88% Li2O and 4.22 mt of Inferred Mineral Resource at a grade of 1.0% Li2O, and are effective as of July 31 2022.

The Mineral Resource estimate, prepared by AMC Consulting, is based on 312 core drillholes during the period of 1955 to 2022, and 858 meters of trenching over the same period.

Changes in the Mineral Resource estimate are attributable to, among other things:

- 23,490 metres surface drilling.

- 1,164 metres additional sampling of mineralization.

- New interpretation of mineralized domains.

- Updated classification.

- Reduced cut off grades calculated from preliminary economic assumptions.

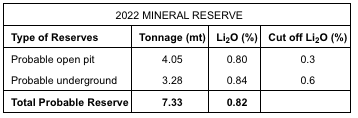

The initial Mineral Reserve estimates, prepared by AMC, are effective as of July 31, 2022 and conform to CIM Definition Standards (2014). All design and scheduling have been completed using the block model generated during the updated Mineral Resource estimate.

The cut-off values supporting the estimation of underground Mineral Reserves were generated using a spodumene concentrate price of USD 1,100 per tonne. The cost assessment indicated that a cut-off grade of 0.3% Li2O for open pit and 0.6% Li2O for underground was appropriate.

Readers are cautioned that Mineral Resources are reported inclusive of Mineral Reserves and that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Areas of uncertainty that may materially impact the Mineral Reserve and/or Mineral Resource estimates or the development thereof include, among others, prices of spodumene concentrate, lithium chemicals, changes to resource modelling methods, geotechnical assumptions and metallurgical recovery assumptions.

Please see the section titled “Risk Factors” in the Company’s 2021 annual information form available on SEDAR at www.sedar.com for further details regarding such risks.

Additional information, including key assumptions, parameters and methods used to estimate the Mineral Reserves and Mineral Resources, will be provided in the new technical report on the Georgia Lake Project to be published within 45 days of this press release.

ABOUT THE PLANT DESIGN

The Georgia Lake Concentrator is proposed to be constructed within the Nama Creek property approximately 160 km northeast of Thunder Bay, Ontario and 16 km south of Beardmore and accessed by the historic Nama Creek Road. It is designed to convert spodumene pegmatite ore into spodumene concentrate via crushing, DMS, and flotation.

The basic process flowsheet was developed and subsequently optimised using data derived from a number of metallurgical test work campaigns completed on drill core samples.

The drill core samples were taken from five spodumene bearing pegmatite veins from the resource called Main Zone North (MZN), Conway (CON), Main Zone Southwest (MZSW), Harricana (HAR), and Line60 (L60).

It is expected that the Georgia Lake Concentrator will consist of a three-stage crushing circuit to reduce feed to below 9.5mm. The first DMS stage is used to reduce the feed mass with a high rejection of low-grade coarse material improving the overall plant feed grade.

The second DMS stage is used to produce a coarse and fine DMS concentrate product via re-crushing. The floats and fines material are milled and prepared for the flotation circuits.

A standard rougher / cleaner spodumene flotation circuit follows the mica flotation stage, and will produce a spodumene concentrate, ready for dewatering.

The process flowsheet for the Georgia Lake Concentrator has been designed to incorporate process unit operations typical to spodumene concentrators using DMS and flotation, taking advantage of specific properties of the Georgia lake deposit. Proven technology within the lithium industry was used to minimise technical risk and time to market.

It is expected that the Georgia Lake Concentrator will be designed for a feed capacity of 150 t/h or 1,000,000 tpa. Key aspects of the Georgia Lake Concentrator are expected to include:

- Li2O content in feed of approximately 0.82 % Li2O

- Li2O content in concentrate approximately 6.0% Li2O

- Li2O overall recovery 80%

METALLURGICAL REMARKS

The test parameters for the PFS were based upon and designed to provide continuity and compatibility with earlier results. Nagrom was engaged to carry out a three-phase metallurgical test program. Approximately 66 kilograms (kg) of ore composite from MZN deposit was selected for head assay sampling.

Both Heavy Liquid Separation (HLS) and Flotation were tested to produce a spodumene concentrate of target grade 6.0% Li₂O. Variability testwork was also undertaken on samples from the satellite ore bodies (MZSW, HAR, LIN60, and CON). For the PFS, a constant metal recovery of 80% is assumed with a concentrate grade of 6%.

PERMITTING & OUTLOOK

Rock Tech will continue to advance the Georgia Lake Project towards feasibility level. Based on the positive results of the PFS, the Company intends to undertake a definitive feasibility study in respect of the Georgia Lake Project, with a production decision expected to be made in 2023.

Permitting activities for the Georgia Lake Project are progressing and expected to be concluded in a timely manner supporting the next phase of development of the Georgia Lake Project.

On behalf of the Board of Directors,

Dirk Harbecke

Chairman & CEO

QUALIFIED PERSONS AND NI 43-101 TECHNICAL REPORT

The PFS for the Georgia Lake Project summarized in this press release will be incorporated in a NI 43-101 technical report that will be filed on the Company’s SEDAR profile at www.sedar.com within 45 days of this press release.

The affiliation and areas of responsibility for each of the independent qualified persons (as defined in NI 43-101) involved in preparing the PFS, upon which the technical report will be based, are as follows:

Each of the foregoing qualified persons has reviewed and approved the contents of this press release. In addition, the scientific and technical disclosure included in this press release, including the information on the 2021 PEA, has also been reviewed and approved by Robert MacDonald, P.Eng, General Manager of the Georgia Lake Project, a qualified person under NI 43-101.

The qualified persons responsible for the preparation of the PFS and the technical report in respect thereof have verified the data disclosed in this press release, including sampling, analytical and test data underlying the information contained herein.

Geological, mine engineering and metallurgical reviews included, among other things, reviewing drill data and core logs, review of geotechnical and hydrological studies, environmental and community factors, the development of the life of mine plan, capital and operating costs, transportation, taxation and royalties, and review of existing metallurgical test work.

In the opinion of the qualified persons, the data, assumptions, and parameters used to estimate Mineral Resources and Mineral Reserves, the metallurgical model, the economic analysis, and the PFS are sufficiently reliable for those purposes.

ABOUT ROCK TECH

Rock Tech is a cleantech company on a mission to produce lithium hydroxide for EV batteries. The Company plans to build lithium converters at the door-step of its customers, to guarantee supply-chain transparency and just-in-time delivery.

To close the most pressing gap in the clean mobility story, Rock Tech has gathered one of the strongest teams in the industry. The Company has adopted strict ESG standards and is developing a proprietary refining process aimed at further increasing efficiency and sustainability.

Rock Tech plans to source raw material from its own mineral project in Canada as well as procuring it from other responsibly producing mines. In the years to come, the Company expects to also source raw material from discarded batteries. Rock Tech’s goal: to create a closed-loop lithium production system.

Rock Tech Lithium completes Pre-Feasibility Study for its Georgia Lake Project, VANCOUVER, BC, November 15, 2022