Piedmont Lithium and LG Chem sign equity investment and binding offtake agreements.

Piedmont Lithium Inc. (“Piedmont” or the “Company”) (Nasdaq:PLL; ASX:PLL), a leading global developer of lithium resources critical to the U.S. electric vehicle (“EV”) supply chain, announced that it has signed agreements with LG Chem, Ltd. (“LG Chem”), under which LG Chem will make a $75 million equity investment in Piedmont (“Subscription Agreement”) and commit to the offtake of 200,000 metric tons of spodumene concentrate (“SC6”) from Piedmont’s jointly-owned North American Lithium (“NAL”) over a four-year term (“Offtake Agreement”).

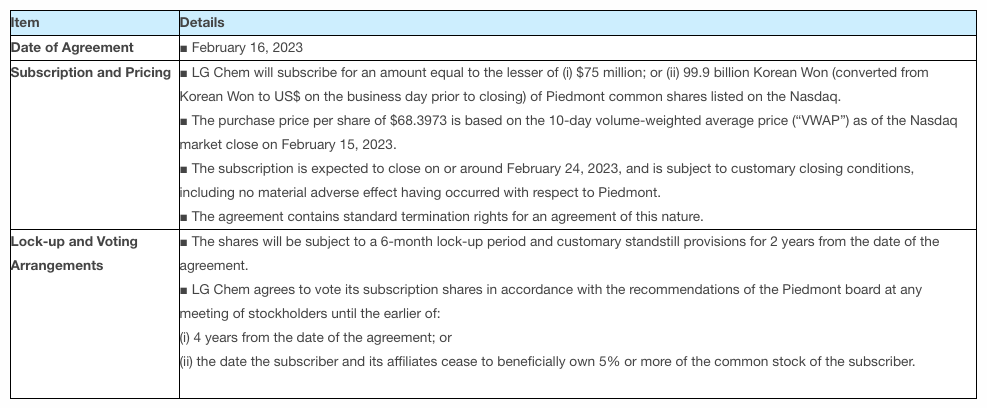

LG Chem will purchase 1,096,535 newly-issued shares of Piedmont common stock at an approximate price of $68.40 per share for a total consideration of $75 million. Closing of the Subscription Agreement is expected on or around February 24, 2023, and will result in LG Chem holding approximately 5.7% of Piedmont common shares. Transaction details are described in the table at the end of this announcement.

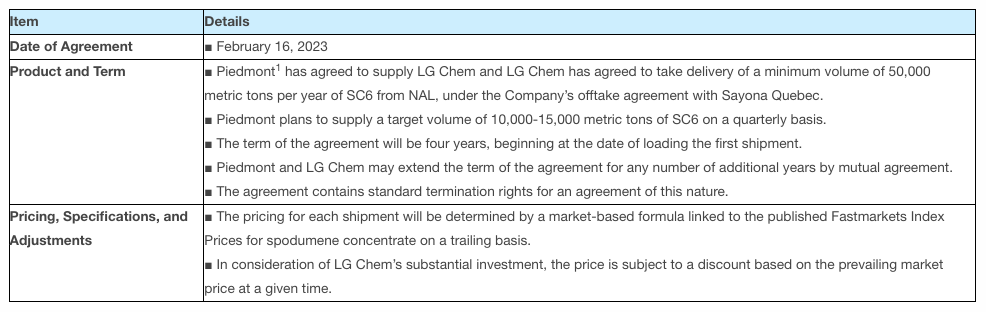

Piedmont has agreed to supply LG Chem with 50,000 metric tons per year of SC6 for four years with planned shipments beginning in Q3 2023. SC6 pricing will be determined by a formula-based mechanism linked to SC6 market prices at the time of each shipment.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

LG Chem will utilize the material to support its plans to produce cathode materials for key North American customers as well as the intentions of the Inflation Reduction Act of 2022 (“IRA”). Piedmont has also agreed to provide LG Chem priority negotiation rights for 10,000 metric tons per year of lithium hydroxide produced by the Company at either of its proposed facilities in Tennessee or North Carolina.

Keith Phillips, Piedmont President and CEO

We welcome LG Chem as a shareholder in Piedmont and are excited to partner with them to supply North American lithium that will meet the requirements of the IRA and support the development of the U.S. battery supply chain.

“LG Chem is a global leader with a commitment to U.S. EV battery manufacturing and plans to build one of the world’s largest cathode plants in Clarksville, Tennessee. We look forward to working with LG Chem as NAL comes online as an important source of lithium in North America.”

Mr. Hak-Cheol Shin, Vice Chairman and CEO of LG Chem, said:

This agreement allows LG Chem to provide differentiated values to North American customers with products that satisfy IRA standards by preemptively securing raw materials in the U.S., our key market.

“As we work to build various partnerships, including joint metal investments with automotive OEMs and battery makers, we’re pleased that our partnership with and commitment of funds to Piedmont will help support its development of U.S. lithium projects.”

NAL is a project of Sayona Quebec, a joint venture between Piedmont and Sayona Mining Limited (ASX:SYA). SC6 production at NAL is expected to restart in H1 2023, with commercial shipments expected to begin in Q3 2023. Piedmont’s offtake agreement with Sayona Quebec entitles Piedmont to purchase the greater of 113,000 metric tons per year or 50% of the joint venture’s SC6 production.

The Company’s purchases of SC6 from Sayona Quebec are subject to a floor price of $500/ton and a ceiling price of $900/ton for the life-of-mine term.

Piedmont intends to utilize the funding from LG Chem to advance its portfolio of projects, including its planned 30,000 metric-tons-per-year lithium hydroxide project at Tennessee Lithium, the Ewoyaa Lithium Project in Ghana in partnership with Atlantic Lithium, and the fully integrated Carolina Lithium project in development in North Carolina, as well as for general corporate purposes.

JPMorgan and Evercore acted as financial advisors, and Gibson Dunn and Thomson Geer served as legal counsel to Piedmont. Allen & Overy acted as legal counsel to LG Chem.

Key terms of Subscription Agreement between LG Chem and Piedmont

Key terms of Offtake Agreement between LG Chem and Piedmont

About Piedmont Lithium

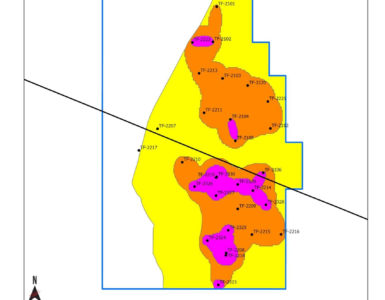

Piedmont Lithium (Nasdaq:PLL; ASX:PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest.

Our projects include our Carolina Lithium and Tennessee Lithium projects in the United States and partnerships in Quebec with Sayona Mining (ASX:SYA) and in Ghana with Atlantic Lithium (AIM:ALL; ASX:A11). These geographically diversified operations will enable us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage.

For more information, follow us on Twitter @PiedmontLithium and visit www.piedmontlithium.com.

About LG Chem

LG Chem is a leading global chemical company with a diversified business portfolio in the key areas of petrochemicals, advanced materials, and life sciences. The company manufactures a wide range of products from high-value added petrochemicals to renewable plastics, specializing in cutting-edge electronic and battery materials, as well as drugs and vaccines to deliver differentiated solutions for its customers.

LG Chem is committed to reaching carbon-neutral growth by 2030 and net-zero emissions by 2050 by managing the impacts of climate change and making positive contributions to society through renewable energy and responsible supply chains. Headquartered in Seoul, Korea, LG Chem has multiple operation sites worldwide and generated consolidated revenue of KRW 51.9 trillion (USD 42.1 billion) in 2022. For more information, please visit www.lgchem.com.

Highlights:

- LG Chem investing $75 million to acquire Piedmont Lithium common shares

- Piedmont to supply LG Chem with 200,000 metric tons of spodumene concentrate over four years

- Agreements illustrate the benefits of the Inflation Reduction Act of 2022, with North American critical minerals supporting the development of a U.S. battery supply chain

Piedmont Lithium and LG Chem Sign Equity Investment and Binding Offtake Agreements, BELMONT, N.C., February 16, 2023