Nevada set to become Lithium Capital of America as industry heats up.

USA News Group – The domestic lithium scene is heating up in the desert of Nevada, as the state makes a strong pitch to become the Lithium Capital of America. Hundreds of millions of dollars are flowing into the state, including a $700 million government loan into a Nevada lithium mine, and a $650 million investment by General Motors Company (NYSE:GM) into Lithium Americas Corp. (NYSE:LAC) (TSX:LAC) and its upcoming Thacker Pass Lithium Mine.

There are several developments occurring at the same time within Nevada’s lithium scene, including expansions from Tesla, Inc. (NASDAQ:TSLA) (NEO:TSLA), ongoing production from Albemarle Corporation (NYSE:ALB), and the continual development of the Jackpot Lake lithium brine project of Usha Resources (TSXV:USHA) (OTCQB:USHAF).

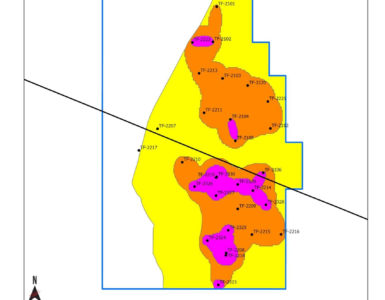

Comprised of 140 mining claims totaling 2,800 acres, Usha Resources’s (TSXV:USHA) (OTCQB:USHAF) Jackpot Lake project is located only 35km NE of Las Vegas, and was previously classified as a “drill-ready lithium brine project” targeting an underground lake with a total closed basin of approximately 10,900 acres—as identified by gravitational surveying.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

According to 3D modeling contained in a previous statement from the company, Usha’s geophysical target is open for expansion in all directions towards the margin of the basin it’s situated within—leaving an opportunity for the company to expand its holdings should it see value in scaling up its operation.

Now Usha has announced the completion of its first hole on the project, and confirmed that Jackpot Lake has a similar geologic setting to that of Clayton Valley, which hosts the Silver Peak Nevada Lithium Mine of Albemarle Corporation (NYSE:ALB), which to-date is still the only producing lithium mine in North America.

Deepak Varshney, CEO of Usha Resources, said:

The significance of evidence supporting the geologic setting coupled with the geological similarities and notable proximity to the sole domestic producer of lithium in the United States bodes well for USHA’s future potential – both near and long-term.

“We have been very pleased with the findings of our maiden drilling program.”

Usha has essentially just finished drilling a hole that goes 1,723ft deep into the ground that found that there are some special rocks that show that the area used to have a lot of water, known as evaporitic crystallization. The company also found a layer of sand and rocks identified as “higher porosity zone comprised of sand and conglomerate with evaporite crystallization” that have a lot of space for water, and this is an important discovery because it means that water can easily move into this space.

As per the preliminary Economic Assessment (PEA) completed by Pure Energy Minerals for their Clayton Valley project, a sand-conglomerate zone was identified in their project to contain a large volume of brine with superior grades of lithium.

“Shallow basins with the characteristics of Jackpot are uncommon and to be able to validate our thesis for the project on the first hole is very exciting,” added Varshney. “Brine projects have the ability to move towards production much quicker than their counterparts in the hard rock space and the identification of heavily crystallized core overlaying permeable pumpable sands and conglomerate shows that Jackpot has the potential to meet this demand in the coming decade.”

Varshney went on to add that the fact that the Biden Administration’s critical mineral requirements will quickly come into effect approximately one year from now is not lost on him, as 50% of battery components will be manufactured or assembled in North America starting in 2024 and increasing to 100% by the end of 2028.

“With the demand for lithium resources accelerating and no capital constraints holding us back, we will drill smartly, test expeditiously, and play to win,” emphasized Varshney.

Albemarle Corporation’s (NYSE:ALB) Silver Peak Nevada Lithium Mine remains the only current North American lithium producer, and thus has already allowed the lithium producer to establish itself as one of the crucial providers of the metal to Tesla, Inc. (NASDAQ:TSLA) (NEO:TSLA) and other EV makers.

As per Albemarle‘s Q3 2022 financials, new wells and expansion projects at Silver Peak continue to progress ahead of schedule, while Kings Mountain mine studies continue to progress positively. A new update from Albemarle’s Q4 2022 is due for release on Feb 15, 2023.

Karen Narwold, Executive VP and Chief Administrative Officer at Albemarle, said:

The U.S. is at the start of really expanding and developing its supply chain domestically for this critical mineral lithium, as well as the broader supply chain for electric vehicles and electrification.

“From Albemarle’s perspective, we think the United States can bring the full supply chain here.”

Beyond its Nevada operations, Albemarle wants to restart a lithium mine in Kings Mountain, North Carolina. The project is seen as a crucial component of a plan by automakers to create the US’s first complete supply chain for electric vehicle batteries, thus reducing the industry’s dependence on China.

Trying to get out ahead of its EV competitors, General Motors Company (NYSE:GM) struck the largest investment by an automaker into a lithium project, through a $650 million investment in Lithium Americas Corp. (NYSE:LAC) (TSX:LAC) and its Thacker Pass lithium project in Humboldt County.

Jonathan Evans, Lithium Americas President and CEO said:

The agreement with GM is a major milestone in moving Thacker Pass toward production.

“We are pleased to have GM as our largest investor and we look forward to working together to accelerate the energy transition while spurring job creation and economic growth in America.”

Through the terms of the deal, GM earned exclusive access to the first phase of a mine planned near the Nevada-Oregon line with the largest known source of lithium in the USA.

Mary Barra, GM Chair and CEO said:

GM has secured all the battery material we need to build more than 1 million EVs annually in North America in 2025 and our future production will increasingly draw from domestic resources like the site in Nevada we’re developing with Lithium Americas.

Currently holding multiple international lithium assets, Lithium Americas has recently stated an intention to separate into two companies, leaving Thacker Pass and the company’s other North American investments to thrive on their own.

After two additional Nevada companies received tens of millions of dollars in grants as part of US President Joe Biden’s Infrastructure Law, Tesla, Inc. (NASDAQ:TSLA) (NEO:TSLA) announced they too will be making an addition $3.6-billion Nevada investment of its own, into a new 4,000,000 sq ft facility, dubbed Giga Nevada. It will include a 100 GWh 4680 cell factory as well as the company’s first high volume Semi factory.

Mitch Landrieu, Infrastructure Coordinator for President Biden, said:

This announcement is the latest in more than $300 billion in private sector investment in clean energy and semiconductor manufacturing announced since the President took office.

“It will create more than 3,000 good-paying jobs in Nevada helping America lead in clean energy manufacturing, strengthening our energy security, and ultimately lowering costs for families.”

Tesla’s initial Nevada investment came in 2014 for its $3.5 billion gigafactory in Sparks in 2014. According to the company, since then, they have invested another total of $6.2 billion in the state, building a 5.4-million-square-foot facility that has produced 3.6 million drive units, 1.5 million battery packs and 7.3 billion battery cells.

Nevada Set to Become Lithium Capital of America as Industry Heats Up, VANCOUVER, BC, February 8, 2023