Lithium producers play a vital role in the electrification of vehicles.

The electrification of automobiles is projected to drive the lithium-ion battery market, considerably increasing demand for lithium-ion batteries in the near future. The growing awareness of the amount of carbon emissions released into the environment from automobiles, plus the recent advances made in battery technology, has helped spur the adoption of electric vehicles around the globe.

This, in turn, has put the burden on manufacturers to offer electric vehicles powered by lithium-ion batteries, instead of adopting other battery alternatives due to their lightweight nature, high energy density, and low cost. According to data provided by Research and Markets, the global lithium market size was valued at USD 7.1 Billion in 2021, and is expected to reach a value of USD 15.45 Billion by 2028, with a CAGR of 11.75% over the forecast period 2022 – 2028.

Foremost Lithium Resource & Technology Ltd. (CSE: FAT) (OTC: FRRSF), Patriot Battery Metals Inc. (OTC: PMETF) (TSX-V: PMET), American Lithium Corp. (NASDAQ: AMLI) (TSX-V: LI), SIGMA Lithium Corporation (NASDAQ: SGML) (TSX-V: SGML), Lithium Americas Corp. (NYSE: LAC) (TSX: LAC).

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Lithium-ion batteries are already heavily adopted due to their compact size, rechargeability, recyclability and high-density energy output.

William Tokash, Senior Research Analyst with Navigant Research, said:

The push by automotive original equipment manufacturers (OEMs) and battery manufacturers to continually reduce battery pack costs continues.

“This effort, led by improving battery manufacturing processes and maturing supply chains, is anticipated to yield a market driven by battery electric vehicles (BEVs), where both large and small capacity Li-ion battery-pack-equipped vehicles have markedly improved driving ranges.”

Foremost Lithium Resource & Technology Ltd. (CSE: FAT) (OTC: FRRSF) just announced breaking news that, ‘it has entered into an arm’s length properties acquisition agreement (“the Property Agreement”) to acquire 100% interest in the Lac Simard South property (the “Property”) in the Province of Quebec Canada, consisting of 120 mining claims covering approximately 20,349 acres/8,235 hectares.’ (See “Investment Summary” section for details).

The Property has 24 pegmatites that were identified from satellite imagery. These pegmatites are located approximately 90KM southwest from The NAL Lithium Processing Plant (A Piedmont/Sayona Joint Venture), which just announced it produced its first batch of spodumene concentrate (SC6) and 80 km southwest of Val-D’or, a logistics hub for mining services. This acquisition increases Foremost’s total lithium land holding to an aggregate of 63,380 acres/25,649 hectares.

Lac Simard South is contiguous to Sayona Mining Limited (ASX: SYA) and Refined Metals Corp. (CSE: RMC) Lac Simard property that sampled 2.1% Lithium Li which is 4.52% Lithium Oxide Li2O and 5.88% Tantalum Oxide (Ta2O5) (Ref. Report GM 36797, 1980). The property is easily accessible year-round by way of well-maintained roads, with little overburden.

Sayona Mining Limited’s Abitibi Hub, comprised of its North American Lithium, Authier Lithium and Tansim Lithium projects located nearby, boasts a measured and indicated resource of 87.8 Mt grading 1.05% Li2O (March 22, 2022 Source: https://sayonamining.com.au/announcements/).

Jason Barnard, President and CEO comments:

We are excited to be adding this pegmatite rich property to our growing portfolio of lithium assets, in addition to moving east in this prospective lithium-dense area of Canada.

“This acquisition is consistent with our focus of acquiring quality assets near known established lithium production and processing regions. Not only is Lac Simard South property in an active lithium camp with large established resources, but we will be located near Sayona’s lithium concentrators and refineries.”

“We couldn’t have picked a better location as it offers year-round access with close proximity to infrastructure enabling us to explore and drill during all seasons. Quebec is known for being the most generous tax-incentive provinces in our country, and our management team has already begun strategizing ways to capitalize on this amazing opportunity for our company and for shareholders.”

Geology – Lac Simard South property is underlain by the large monzodiorite batholith of Lac Simard Sud. This batholith is pinkish grey in color and is composed of plagioclase, K-feldspar hornblende with minor amount of epidote and quartz.

Quartz-monzodioritic dykes and sills are observed at the margin of this intrusion. The Ni-Cu Laforce showing explored by Kerr Addison Gold Mines Ltd and more lately by Fieldex Exploration (2007) lies about 1 km south of the Property.

Summary of Investment – Pursuant to the Property Agreement, Foremost Lithium will pay to the vendors an aggregate cash consideration of $50,000 plus GST payable upon closing and an additional $50,000 plus GST payable within 4 months after closing.

In addition, the Company will issue a total of 1.5 Million Units (the “Unit”) comprised of common shares of the Company (the “Shares”) at a deemed price of $.21 per 1 common share and 1.5 Million purchase warrants (the “Warrants”) with each warrant exercisable at $.35 per warrant for a period of three years. The Shares and Warrants will be subject to a hold period of four months and one day from the date of issuance.

The company intends to begin an active work program to test the identified pegmatites associated in this active lithium, mining, and refining region of Quebec. It is intended that an exploration program will include ground truthing – boots on the ground as a first step to confirm and describe the nature of the identified pegmatites as well as prospecting selected areas to find lithium-bearing pegmatites.

The Company anticipates using indirect techniques such as EarthEx drone-assisted magnetic survey in addition to surficial geochemical surveys including Mobile Metal Ions (MMI Technology) to contemplate areas with scarce outcrops to help delineate new targets prospective for lithium-bearing pegmatites. Once the targets are determined, a projected drilling program will follow.

Technical information relating to the Lac Simard South Property contained in this news release has been approved by Isabelle Robillard, P. Geo, who is a ‘Qualified Person’ within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Patriot Battery Metals Inc. (OTCQX: PMETF) (TSX-V: PMET) announced on February 13th, assay results from its 2022 drill and surface exploration programs over the CV13 Pegmatite cluster at its wholly owned Corvette Property (the “Property”), located in the James Bay Region of Quebec.

The CV13 Pegmatite cluster, which is comprised of two contiguous lithium outcrop trends totaling 2.3 km in combined strike length, is located approximately 4.3 km along geological trend to the southwest of the CV5 Pegmatite.

Darren L. Smith, the Company’s Vice President of Exploration, comments:

The results from the first pass drill testing at CV13 are very positive with ten (10) of our first fourteen (14) drill holes along this collective 2.3 km trend returning strong lithium mineralization.

“The CV13 Pegmatite cluster is a grassroots discovery from summer 2022 and to advance over several months to an intersection of 22.6 m at 1.56% Li2O in our first series of drill holes is an impressive feat and highlights again the magnitude of the mineralized system(s) and continued potential for new discoveries at the Corvette Property.”

American Lithium Corp. (NASDAQ: AMLI) (TSX-V: LI) announced on February 1st, the results of its maiden Preliminary Economic Assessment (“PEA”) for the Tonopah Lithium Claims (“TLC”) project located in the Esmerelda lithium district northwest of Tonopah, Nevada.

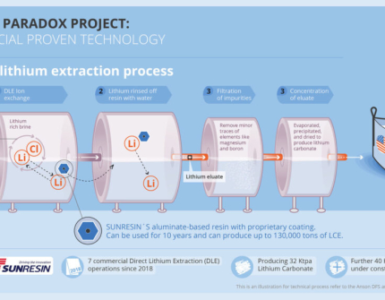

This independent PEA was completed jointly by DRA Global and Stantec Consulting Ltd. (“Stantec”) and demonstrates that the TLC project has the potential to become a substantial, long-life producer of low-cost lithium carbonate (“LCE” or “Li2CO3”) with the potential to produce either battery grade LCE or lithium hydroxide (“LiOH”).

The PEA base case envisions an initial 4.4 Million tonnes per annum (“Mtpa”) processing throughput expanding to 8.8Mtpa. The PEA alternative case is identical, but with added production of high purity magnesium sulfate as a by-product over life of operations.

Simon Clarke, CEO of American Lithium, states:

We are extremely pleased to announce a very robust maiden PEA for TLC.

“Our team has worked hard and spent considerable time getting an in-depth understanding of TLC mineralization and the best way to recover high purity lithium utilizing conventional processing methods with the latest techniques and best in class plant and equipment.”

“A significant portion of the processing work has been done to pre-feasibility levels as we believe this will help us move quickly through the next phases of development. At 99.4% LCE purity, TLC offers the capability to produce either battery grade lithium carbonate or hydroxide with minimal additional refining.”

Lithium Producers Play a Vital Role in the Electrification of Vehicles, NEW YORK, March 20, 2023