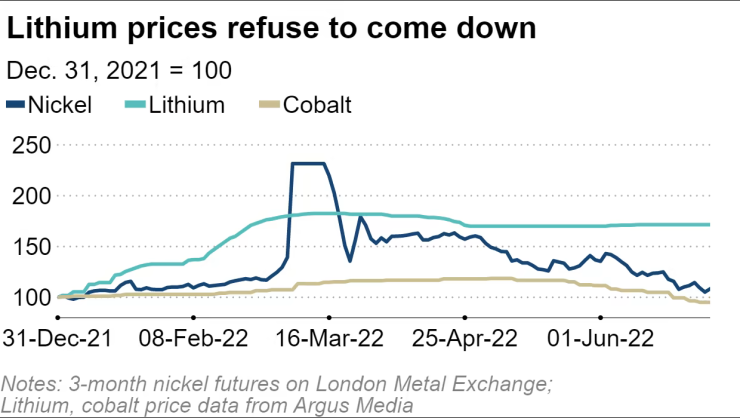

Lithium price stays sky-high as other EV battery metals come down to earth.

Prices for key metals used in electric-vehicle batteries have diverged, with lithium holding strong on brisk demand and tight supply while nickel and cobalt start to fall out of favor in the crucial Chinese market.

All of these materials are used in cathodes. These components make up about 40% of the cost of a battery cell, which itself accounts for a sizable chunk of electric vehicle production expenses.

Lithium remains a major contributor to these costs. A benchmark price for lithium carbonate stood at about 470,000 yuan ($70,000) per ton according to Argus Media. While this represents a 6% dip from the mid-March peak, it is still up 70% from the end of 2021, and close to the highest point in data going back to 2016.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Nickel’s gains have been modest by comparison, at about 8% this year. Three-month futures on the London Metal Exchange were priced at $22,499 per ton Monday, down 53% from the most recent peak on March 7, when prices spiked in chaotic trading against the background of the war in Ukraine.

Cobalt peaked in May before sinking in June, and is now down 5% from the end of last year, at about $32 per pound.

The difference owes partly to a shift in battery technology. The current mainstay throughout most of the auto industry is the nickel-manganese-cobalt (NMC) battery, which enables long driving ranges and has been used by Tesla and others.

But lithium iron phosphate (LFP) batteries have recently gained ground, with production growing rapidly in China — a market that accounts for half of global electric vehicle sales.

Iron phosphate is cheaper than nickel and cobalt, a factor that has drawn Chinese automakers toward LFP cells as mass-market electric cars of NMC battery materials soar.

LFP batteries cost about 20% less than their NMC counterparts, and are considered to be safer as well. They are now used in nearly 60% of electric vehicles in China, according to a battery metals specialist at a trading house. Tesla is shifting to LFP cells for its mainstay Model 3.

Goldman Sachs projects that LFP batteries will make up nearly 40% of the market by 2030, compared with less than 30% now.

A pivot away from NMC batteries would dim the outlook for nickel and cobalt demand in the auto industry.

Junichi Tomono at Japanese metals trader Hanwa, said:

On the other hand no matter how the battery mainstream changes, demand for lithium looks likely to remain high, and prices to stay firm.

There are differences on the supply side as well. Lithium supplies look likely to remain tight. Mines in Australia and elsewhere shut down when the market was weak and have been slow to respond to the rebound in demand. Production is not expected to ramp up until next year or later.

Lithium refining in China has been another bottleneck. Though Beijing has loosened electricity restrictions that have contributed to the problem, many market watchers do not expect the supply shortage to be resolved for the time being.

A recovery looks more certain for nickel and cobalt. Nickel surged in March in response to economic sanctions against Russia, a major supplier, but Indonesia is expected to step up production of nickel ore. Cobalt output is expected to rise in the Democratic Republic of the Congo.

Nickel has also been hit by speculator investors’ exit from nonferrous metals as accelerating interest rate hikes in the U.S. reduce their appetite for risk.

Sourcing lithium has become a major priority in EV competition. Australia, Chile, China and Argentina produce over 90% of the world’s lithium. While many Chinese battery makers have stakes in lithium mines, only a handful of Japanese companies do, including Toyota Tsusho and Hanwa.

Japanese battery makers instead rely largely on imports, though rising prices and a weakening yen have made sourcing the material more difficult.

Lithium stays sky-high as other EV battery metals come down to earth, Tokyo, July 6, 2022