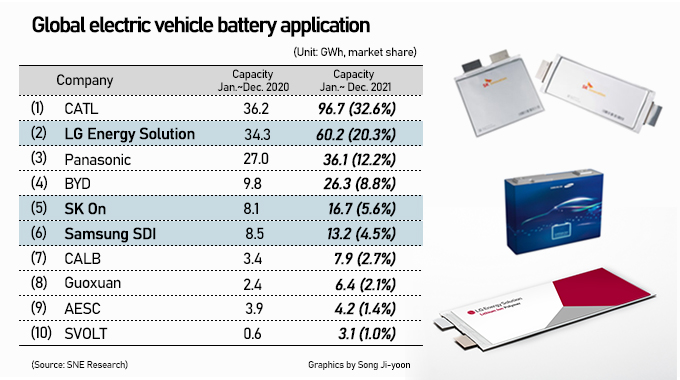

Korean battery majors defend 30% market share amid rise in Chinese competition.

South Korea’s three battery majors LG Energy Solution, SK On, and Samsung SDI maintained combined 30 percent share in powering electric vehicles around the globe as they expanded sales outside China despite aggressive expansion by Chinese players and chip shortages.

According to market watcher SNE Research, Korean batteries were mounted on EVs in 90.1 Gigawatt-hours (GWh), surging 77 percent on year, last year when combined global battery demand for pure EVs, plug-in hybrid vehicles, and hybrid vehicles surged 102.3 percent from a year ago to 296.8GWh.

LG Energy Solution took up 20.3 percent to keep to No. 2 through a 70 percent surge in growth from robust sales of Tesla Model Y and Volkswagen ID.4, although its share fell from a year ago.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

SK On, a latecomer in battery production among Korean players, beat Samsung SDI to rank No. 5 with a 5.6 percent share with doubled sales.

Samsung SDI expanded by more than 50 percent, but its share fell to 4.5 percent.

Their combined share lost 4 percentage points to 30.5 percent due to bigger expansion by Chinese competitors.

China’s CATL topped with a share of 32.6 percent (96.7GWh). BYD, CALB, and Guoxuan came fourth, seventh, and eighth, respectively. Japanese battery makers, including Panasonic, saw their market shares fall.

Their performance this year will likely hinge on lithium supply, the research paper noted.

According to SNE Research, the demand for lithium for secondary batteries will double from 529,000 tons in 2022 to 1,043,000 tons in 2025. The market tracker predicted crunch in lithium supplies in 2025 due to surging demand and supply bottleneck.

READ the latest Batteries News shaping the battery market

Korean battery majors defend 30% market share amid rise in Chinese competition, February 8, 2022