High nickel battery chemistries led the pack in 2021 – Adamas Intelligence.

Global EV Sales Up 83% Year-over-Year in 2021, Battery Capacity Deployment Up 113% Over Same Period

As noted in a recent insight, 2021 saw a record 286.2 GWh deployed onto roads in the batteries of new passenger EVs globally, a massive 113% leap over 2020 as global EV sales jumped 83% over the same period, according to Adamas Intelligence.

Over 98% of all watt-hours deployed in 2021 went into plug-in electric vehicles (i.e., BEVs and PHEVs) alone.

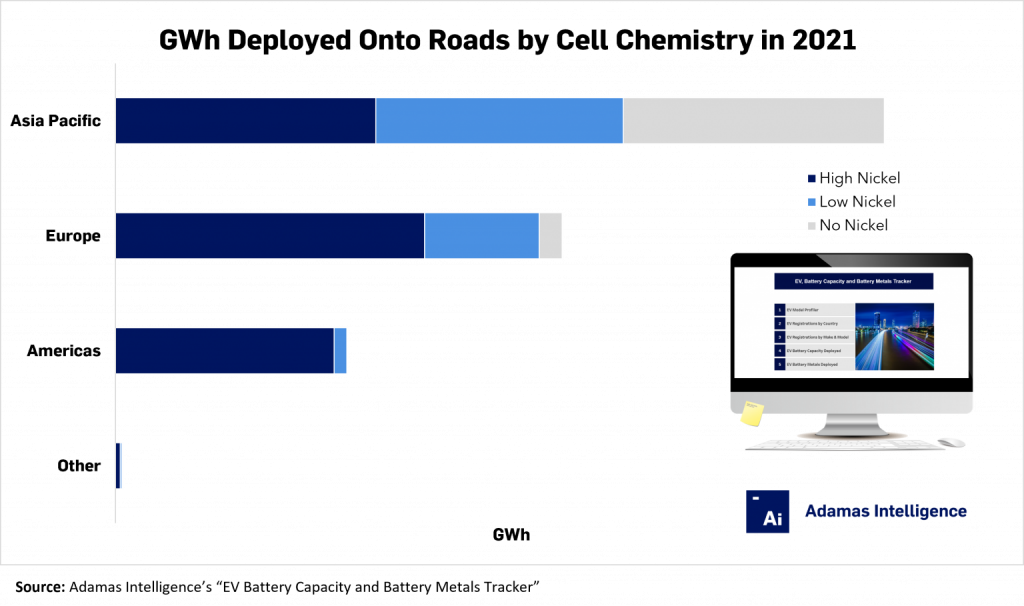

High Nickel Chemistries Captured Over Half the Market by GWh Deployed

In 2021, 54% of battery capacity deployed onto roads globally in new plug-in electric vehicles was powered by “high nickel” cathode chemistries (i.e., NCM 6-, 7-, 8-series, NCA, NCMA), 26% by “low nickel” cathodes (i.e., NCM 5-series and lower) and 20% by “no nickel” cathodes (i.e., primarily LFP).

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Regionally, deployment of high nickel chemistries was most prevalent in the Americas on the back of Tesla, VW, Ford, Hyundai and others, while deployment of no nickel cells was most prevalent in Asia Pacific, and particularly China, on the back of Tesla, BYD, SGMW, Great Wall and a long list of others.

Like the Americas, Europe saw miniscule deployment of no nickel cells onto roads in 2021 but unlike the Americas saw a greater proportion of its watt-hours deployed powered by low nickel cells, albeit high nickel still dominated the region.

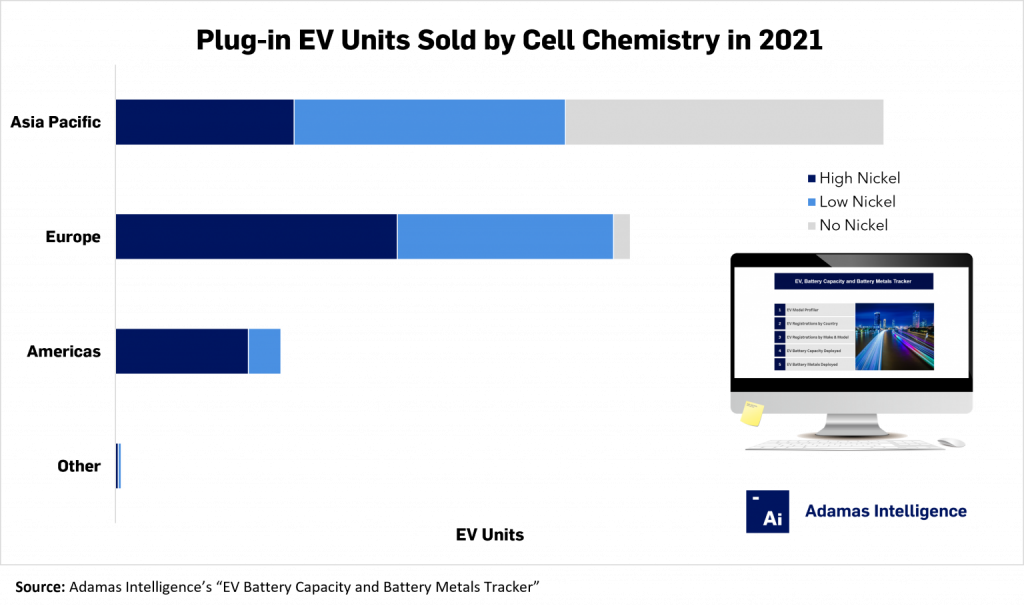

LFP Captured a Fifth of the Market by GWh Deployed but Nearly a Quarter by EV Units Sold

While no nickel chemistries (mainly LFP) captured one fifth of the global plug-in electric vehicle market in 2021 by watt-hours deployed, they were present in nearly one quarter of all vehicles sold.

In Asia Pacific specifically, no nickel chemistries seized 34% of the plug-in electric vehicle market by battery capacity deployed onto roads in 2021 albeit no nickel cells were present in over 41% of all vehicles sold.

This disparity stems from the smaller sales-weighted average pack capacities of LFP-powered EVs relative to low and high nickel alternatives.

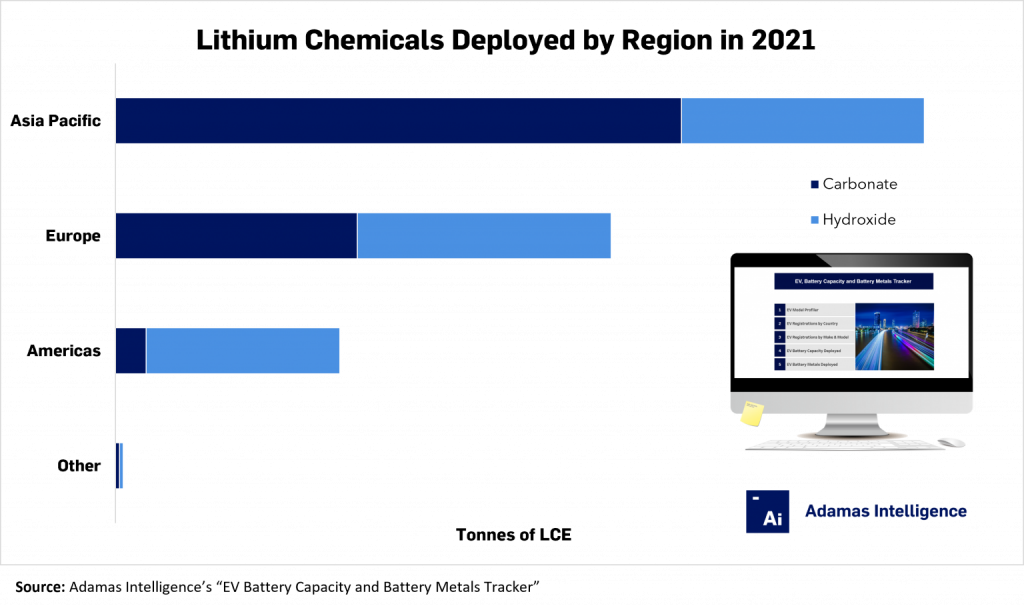

Lithium Hydroxide Ahead in the Americas and Europe, Lithium Carbonate in Asia Pacific

With varying levels of use across chemistries and regions comes varying levels of demand for lithium chemical precursors.

In the Americas, over 86% of all lithium carbonate equivalent (“LCE”) units deployed onto roads in 2021 were in the form of lithium hydroxide. In Europe, this proportion amounted to a lower 51% and in Asia Pacific just 30%, speaking to the regional preferences for high, low and nickel chemistries.

At the global level, 45% of all LCE units deployed onto roads globally in 2021 were in the form of lithium carbonate and 55% lithium hydroxide.

Global Lithium Deployment Up 110% Year-over-Year

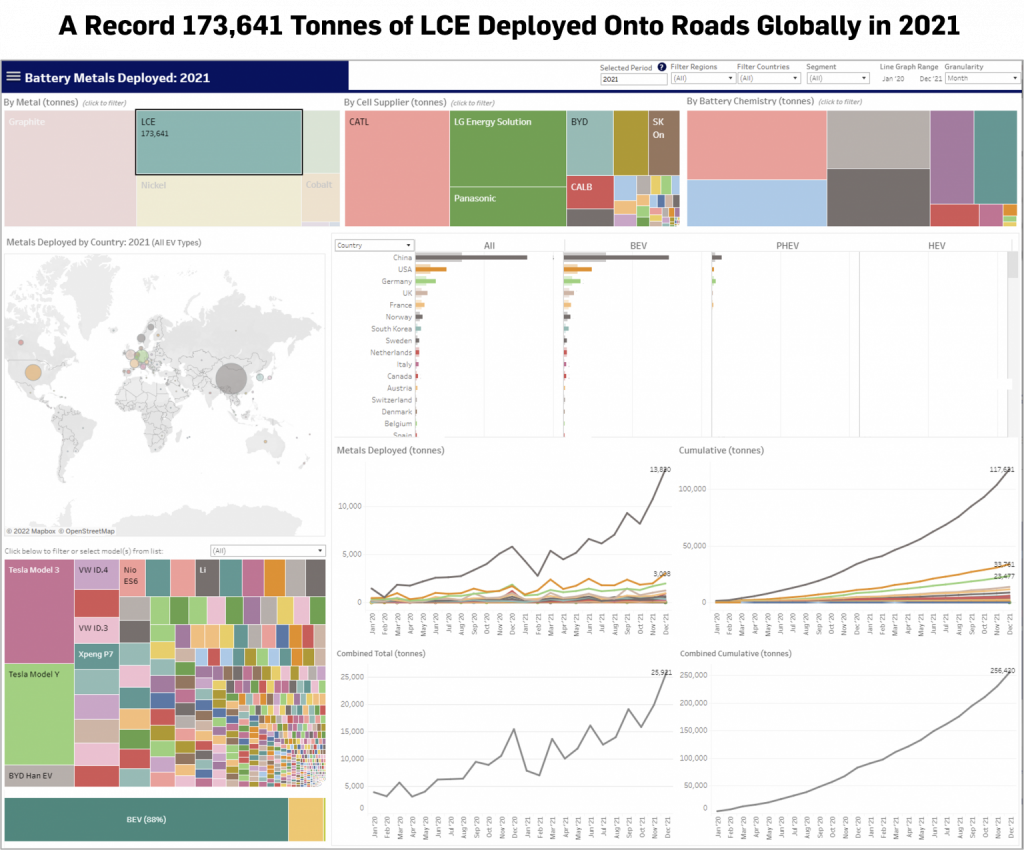

In 2021, a record 173,641 tonnes of LCE were deployed onto roads globally in newly sold passenger EVs, up 110% year over year, according to Adamas Intelligence data.

READ the latest Batteries News shaping the battery market

High Nickel Battery Chemistries Led the Pack in 2021, February 16, 2022