Graphene supply outstrips demand, reports IDTechex.

As of mid-2022, the global graphene and graphene oxide installed capacity easily exceeds 12,000 tonnes per year, but utilization is low as the orders lag significantly behind. Is this a natural part of the commercial journey, or has hype overcome reality?

Is this a case of “build it, they will come”, or are there real market needs? What does the future hold for these graphene manufacturers? IDTechEx provides an independent perspective on these questions and more.

In the latest update to their leading market report, “Graphene Market & 2D Materials Assessment 2023-2033“, IDTechEx provides the most comprehensive view on the industry. This includes interview-based player profiles, granular 10-year forecasts, application deep-dives, and benchmarking studies.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

For a long time, the graphene industry would cite a “chicken and egg” scenario: large demand for their material but limited scale and challenges investing in high volume production without orders or revenue. This has now been broken, IDTechEx has tracked this industry in detail for over a decade and can report that there is extensive capacity, but huge orders haven’t materialized.

Firstly, it should be acknowledged that graphene related materials are a very broad family, from graphene oxide (GO) and reduced graphene oxide (rGO) to Few-layer graphene (FLG), graphene nanoplatelets (GNP), CVD graphene films, and more.

This article will just focus on rGO and GNPs, but even within that, there is a huge amount of variation from lateral size, number of layers, purity, surface area, and this is before we talk about functionalization, the inclusion in intermediates, and the commercial side, specifically cost and price.

So, although there may be a large installed capacity it may not be in the type of graphene desired.

There is also the question of standardization and regulation. Regulation is a significant barrier in many regions, and for many applications, this is slowly progressing with some key announcements but takes time.

Unsurprisingly, unlike mature material markets that operate globally, nearly all graphene players have only one site and predominantly sell in their local market. The geopolitical situation and heightened vulnerability of supply chains present both an opportunity and a threat to these early-stage companies.

The key question is about demand. As has always been the case, graphene maintains an extensive list of potential applications at various stages of market entry and penetration; although not immediately apparent, orders have been arriving, and sales have been rising.

The slow pace is not surprising, each industry takes time to assess the graphene products on the market, test and validate the use-cases, and evaluate the value-add all before engaging in any notable commercial adoption.

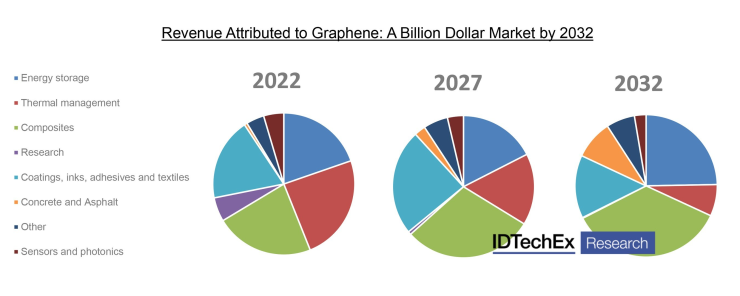

Taking the bigger picture, the applications where there is a good promise and the potential for the highest sales in the long term are energy storage, polymer composites, and concrete.

There will be other success stories with reasonable revenue, such as in textiles, filtration membranes, coatings, and thermal management, but it is these three use cases that, if graphene were to be meaningfully adopted, can generate sales in the tens of thousands of tonnes and would redraw the commercial landscape.

This follows on to the question of when there is major success, how will that reshape the industry? Considering rGO and GNPs are predominantly used as an additive, we can look at similar mature markets for comparison.

Carbon black is the most obvious example where the sales volumes are in the millions of tonnes, it is a consolidated market with comparatively low margins; MWCNTs are the older sibling of graphene and having finally found a killer application in the cathode of lithium-ion batteries, we are seeing the entry of major players, price decreases, significant supply chain agreements, and the clear market leaders accelerating away from competitors; see the market report “Carbon Nanotubes 2022-2032: Market, Technology, Players” for more.

IDTechEx expects a similar future for GNP and rGO, in the long-term, there will not be the same number of graphene manufacturers as there are now (despite more emerging); the first sign of this consolidation, and the perils facing graphene manufacturers, was seen in August with NanoXplore purchasing a significant proportion of the assets of XG Sciences after they ceased operation. Equally, for the highest volume applications, it will become a race-to-the-bottom in price.

The M&A activity is also growing more interesting, with quiet but significant activity from large graphite and chemical companies beginning to position themselves.

So, who will be the graphene market leaders? There are early leaders based on capacity, sales, partnerships, and other key metrics, all of which are tracked in the market report. There is also the question of investment, which considering nearly all graphene players (excluding a handful) are loss-making, is significant for cash flow and growth.

Many companies overestimate the ease, capital cost, and personnel requirements to dramatically scale-up production and overcome all the commercial barriers.

In IDTechEx’s opinion, the long-term future is bright for graphene and will narrowly exceed US$1 billion by 2032, but many have misjudged the initial market pull and mid-term expected size. Hype is a great way to fuel industry but can easily lead to disillusionment.

This article has just focussed on the graphene manufacturers. There is also significant market activity across the value chain, including those claiming key functionalization IP, masterbatch producers, system providers, and end-users. Some are vertically integrated, and others remain supplier agnostic.

These have their own technology readiness, competitive landscape, barrier to entry, and addressable market. This article has presented victory as being one of the major future graphene manufacturers, but that is not the case; a company with a graphene-enabled solution could carve out a high-performance niche with excellent margins.

The early stages of this are already being observed, from supercapacitors to environmental remediation solutions, and plenty more to explore.

As mentioned earlier, there are many more types and forms of graphene than those discussed in this article and a large family of 2D materials beyond graphene entirely; these are at an earlier stage with very different trajectories and global impacts. This is all discussed within the IDTechEx market report.

The graphene market is traveling through an inflection point. The industry will look significantly different in 10 years’ time, even more so than comparing the market to 2012. For an unbiased and comprehensive overview of the current graphene market and its outlook, then see the update to the leading report on the topic, “Graphene Market & 2D Materials Assessment 2023-2033“.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

READ the latest Batteries News shaping the battery market

Graphene Supply Outstrips Demand, Reports IDTechEx, BOSTON, September 13, 2022