Europe EV gigafactory capacity pipeline grows 6-fold to 789.2gwh to 2030, Berlin summit to dissect battery megatrend.

Europe has become the fastest growing region for new electric vehicle (EV) lithium ion battery capacity outside of China.

As the energy storage revolution and demand for lithium ion battery cells continues to rocket, plans for gigafactories – super-sized battery plants that are an order of magnitude bigger than their predecessors – are being developed in parallel.

Just three and a half years ago, Benchmark’s Lithium ion Battery Gigafactory Assessment (September 2018) reported Europe’s battery cell capacity to be at 120GWh by 2030 – enough cells for 2.2m EVs.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

Now this planned annual capacity figure stands at 789.2GWh in 2030, more than a 6-fold increase and enough to produce almost 15 million pure EVs as this global battery arms race takes hold in Europe.

But the question remains how much of this capacity will come onstream and in what quality?

Benchmark Mineral Intelligence puts this subject under the microscope at its first in person event since the pandemic began: Battery Megafactories Europe 2022, 22-23 March, Berlin, Germany.

Our guest of honour is former Tesla Senior Director – Battery Technology, Kurt Kelty and now VP Commercialisation at Sila Nanotechnology.

Mr Kelty is a true pioneer, responsible for building the original supply chains for the first ever super sized battery plant, the Tesla Gigafactory 1 in Nevada, USA.

Industry Speakers include: SVolt, Envision AESC, InnoENERGY, Northvolt, Umicore, Livent, Britishvolt, and ElevenES (LFP).

Each event session is underpinned by Benchmark Mineral Intelligence keynote analysis for each link in the EV battery supply chain.

- Simon Moores (CEO) – Building a lithium ion economy in Europe

- NCM v LFP: Competing or complementary – Andrew Miller (COO)

- Rise of the battery gigafactories in Europe / Caspar Rawles (CDO), Hanisha Tirumalasetty (Analyst Battery Cells)

- The great raw material disconnect – Daisy Jennings-Gray (Senior Analyst)

- Unpacking ESG for the lithium ion battery supply chain – Charlotte Selvey-Miller (Head of ESG)

- Expert chair – Henry Sanderson (Executive Editor and formerly of the Financial Times)

To speak and sponsor, contact our Director of Events, Ben Ash at bash@benchmarkminerals.com.

RISE OF THE BATTERY GIGAFACTORIES IN EUROPE: 2022 V 2030

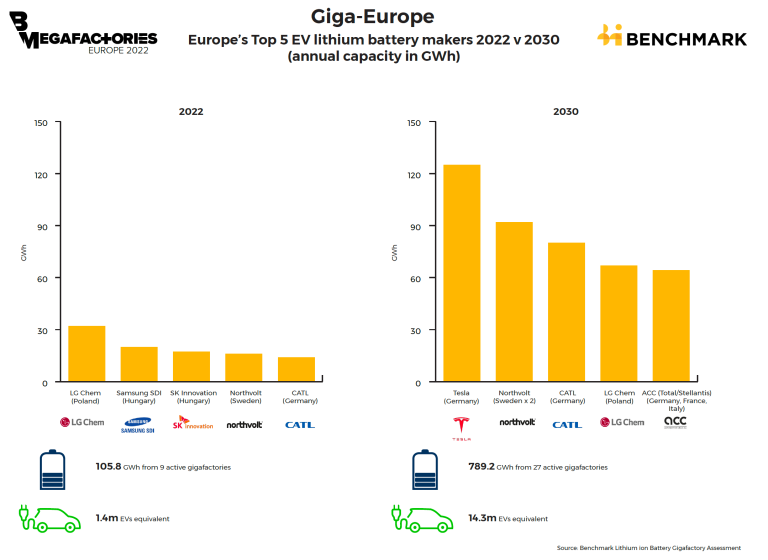

By end-2022, Europe is set to have 7 active lithium ion battery producers of which the top five by capacity (and gigafactory location) are:

- LG Chem (Poland): 32GWh

- Samsung SDI (Hungary): 20GWh

- Northvolt (Sweden): 16GWh

- SK Innovation (Hungary): 7.5GWh

- Envision AESC (UK): 1.9GWh

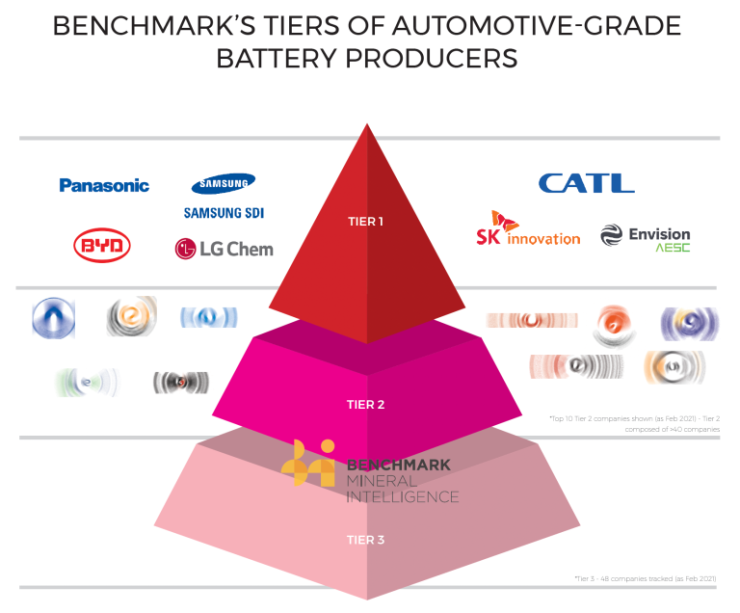

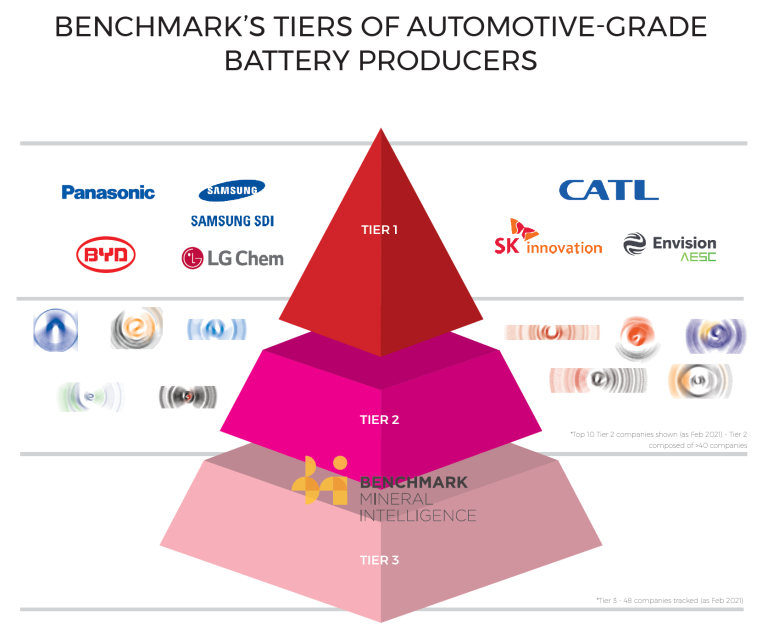

In terms of quality, Europe has 4 of the world’s 7 tier one lithium ion battery makers and once Northvolt’s gigafactory in Sweden is active Benchmark anticipates this will also become a tier one producer.

Benchmark’s Tier One producers of Automotive-grade lithium ion battery cells, as of our February 2022 assessment, are (HQ): Panasonic (Japan); Samsung SDI and SK Innovation (South Korea); Envision AESC, CATL, and BYD (China).

BENCHMARK’S TIERS OF AUTOMOTIVE LITHIUM ION BATTERY PRODUCER

By 2030, this top five landscape will be reshaped as Benchmark’s Gigafactory Assessment (February 2022) shows Europe to be on track for 27 gigafactories from 18 battery cell producers.

A more recent trend with Europe’s lithium ion battery build out is the emergence of auto majors as pseudo-battery producers seeking to secure cell supply through joint-venture plants.

In 2030, of the 17 gigafactories with a minimum annual capacity of 1 GWh in Europe, 8 of these plants are through automotive partnerships such as VW Group, Stellantis (the company created from the Fiat Chrysler Automobiles and the French PSA Group merger), Nissan, Volvo and Renault.

Of most significance is Tesla’s Berlin Gigafactory which is expected to officially commission commercial cell production in 2023 but reach a capacity of 75 GWh by 2026 and be operating at 125 GWh by 2030.

As a result, Giga-Berlin is on course to be Europe’s largest gigafactory by some way and the world’s second largest lithium ion battery plant behind its counterpart in Austin,Texas.

An expanded Northvolt is forecasted to be the region’s second second largest producer with 92 GWh of capacity through plans in Skellefteå, Sweden and a new joint-operation with Volvo, in Gothenburg, Sweden.

CATL, Erfurt will be third largest battery producer in Europe with 80 GWh by 2030

LG Energy Solutions (formerly LG Chem) is expected to be fourth with 67 GWh from Poland with no new gigafactory locations yet announced from the traditionally more conservative South Korean producer.

Meanwhile, ACC (Total/Stellantis) is expected to be operating three plants in France, Germany and Italy with a combined capacity of 64 GWh by 2030 with Verkor’s new Dunkirk-based Gigafactory to be at 50 GWh as the sixth largest producer.

By 2030, Benchmark anticipates Europe’s top five battery makers by capacity to be:

- Tesla (Germany): 125GWh

- Northvolt (Sweden x 2): 92 GW

- CATL (Germany): 80 GWh

- LGES(Poland): 67 GWh

- ACC (Total/Stellantis) (Germany, France, Italy): 64 GWh

Overall, Benchmark is forecasting Europe to have a capacity of 789.2GWh by 2030, little over 14% of the global total of 5,454GWh.

This is a more than 6-fold increase on what we expect for 2022, yet for comparison China is growing by 220% in the same period, while the USA is forecast to grow its battery capacity by 575%.

Is critical to note this data is Benchmark’s assessment in February 2022 yet the data is continually evolving. This is why Benchmark created its Gigafactory Assessment from scratch, to create world class data sets that the biggest decisions of the energy storage revolution rely upon.

To keep up to date with one of the most fast paced industries in the world, subscribe to Benchmark’s Gigafactory Assessment here.

BATTERY CAPACITY DOES NOT NECESSARILY EQUAL EV-READY SUPPLY

It is crucial to note however that capacity does not necessarily equal reliable supply for the EV industry.

There are a number of bottlenecks in building and operating these super-sized battery plants that can take five-years to build and fully ramp up.

A number of topics under discussion at Battery Megafactories Europe 2022, 22-23 March in Berlin are:

- Timelines to building and scaling Gigafactories and how does this align up with EV production plans

- EV Quality and quantity of battery cell production – understanding Benchmark’s Automotive Battery Tiering System

- Building corresponding cathode and anode capacity

- The great raw material disconnect: battery-ready supply of lithium, cobalt, nickel, graphite and manganese to feed Europe’s supply chain

- Building sustainable supply chains: ESG, battery recycling and transparency

READ the latest Batteries News shaping the battery market

EUROPE’S EV GIGAFACTORY CAPACITY PIPELINE GROWS 6-FOLD TO 789.2GWH TO 2030; BERLIN SUMMIT TO DISSECT BATTERY MEGATREND, March 7, 2022