Chinese electric car sales will continue to boom as motorists shrug off price hikes caused by surging lithium battery costs, say analysts.

A five-fold surge in lithium prices that has forced green carmakers to lift their prices in the past two months will do little to dim the prospects for electric vehicle (EV) sales in China, analysts said.

The retail prices of nearly 30 models sold in China have been raised since January, by between 1.4 and 13.9 per cent, according to a tally by Fitch Ratings.

Contemporary Amperex (CATL), a lithium-ion battery producer in Fujian province, has raised the price of the batteries that make up nearly half the cost of an electric car to cope with surging materials costs, said sustainability data and research provider Miotech in a report on April 9.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

But the resulting rise in EV prices is unlikely to put off Chinese motorists keen to make the switch to environmentally-friendly cars, analysts said.

Fitch Ratings’ analysts wrote in a report on April 4:

Chinese EV deliveries are likely to remain robust over the coming months with strong order backlogs, despite the recent price hikes due to surging battery costs.

“Fitch maintains a positive view on China’s EV market as demand remains strong. We expect wholesale deliveries to rise by over 50 per cent and market share [of the whole vehicles market] to exceed 20 per cent in 2022.”

The price increases have not deterred customers so far this year, said Casey McLean, a portfolio manager at fund house Fidelity International in an emailed commentary. Electric car maker BYD posted an increase in orders last month after raising its prices in China.

The fuel bill savings compared to internal combustion cars are still compelling, especially considering recent spikes in petrol prices after the war in Ukraine broke out in late February, he said.

Casey McLean, said:

Even at the more pessimistic end of the spectrum of growth projections, the view is that electric vehicles’ penetration will more than double over the next three years to 39 per cent of the overall market.

Better-than-expected global demand for electric cars and spiralling commodities prices have fuelled a rise in battery material prices since early last year.

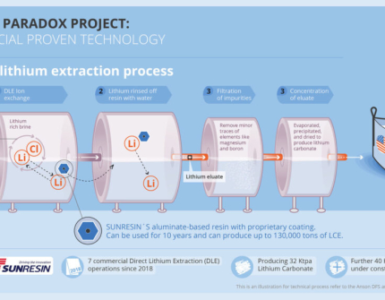

The long development cycle of lithium mines – 15 to 17 years from first discovery to full operation – is the main reason for the tight supply.

For example, LiPF6, a chemical that makes up half the cost of an electrolyte, one of the four main components of lithium-ion batteries, saw its spot market price skyrocket from 70,000 yuan a tonne in mid 2020 to 565,000 yuan by the end of last year. It has since fallen to around 450,000 yuan early this month.

This meant the lithium salt suddenly accounted for over 30 per cent of the entire EV battery’s material cost, compared to around 6 per cent early last year.

Nickel, which is used in some EV batteries, has also seen prices spike sharply after the Russia-Ukraine military conflict broke out in late February.

Russia was the world’s third largest nickel miner last year, accounting for 9.3 per cent of the output, according to US Geological Survey.

Rising output of lithium materials has started to relieve tight supply and cool runaway prices since last month, Miotech said.

“This is starting to improve downstream [industry] profits,” it said.

This is despite logistics challenges and delays caused by the citywide lockdown of Shanghai, one of the nation’s biggest automobile manufacturing hubs.

Still, the global lithium supply is forecast to run a deficit of over 20,000 tonnes both this year and next, before turning to a surplus of 37,000 tonnes in 2024, according to a forecast by Daiwa Capital Markets’ analysts.

EV battery makers and traders of key materials have coped with the price surge by drawing down inventory and delaying purchases, according to Miotech.

Highlights:

- The prices of nearly 30 models sold in China have been raised since January, by between 1.4 and 13.9 per cent, according to Fitch Ratings

- But this is unlikely to put off Chinese motorists keen to make the switch to environmentally-friendly cars, analysts said

Chinese electric car sales will continue to boom as motorists shrug off price hikes caused by surging lithium battery costs, say analysts, April 13, 2022