CATL aims for ‘battery as a service’ hegemony in China.

Top maker of car batteries is building stations for fast swapping.

Contemporary Amperex Technology (CATL), China’s world-leading manufacturer of automobile batteries, is stepping up preparations to launch battery rental services for electric vehicles.

“Battery as a service,” or BaaS as the model is known, will allow drivers to rent and swap out batteries under a subscription pricing model. A depleted battery can be swapped for get a fresh one in as little as a minute, CATL said.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

CATL currently faces a series of challenges on realizing the service, such as constructing facilities and getting cooperation from EV manufacturers.

But if CATL, which has captured around half of the market for car batteries in China, sets standards for the service in cooperation with the Chinese government, even leading Japanese, American and European automakers will have to adapt.

In Amoy, a major port city in China’s southern province of Fujian, CATL began the swap service for local taxi companies in April at a battery swapping station it built. Vehicles are mechanically lifted so their batteries can be replaced from below. Drivers do not even need to get out during the automated process.

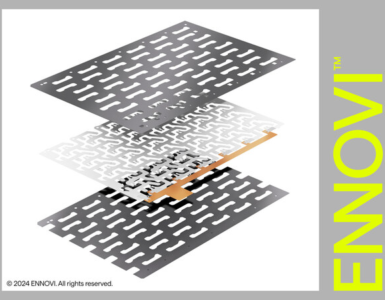

CATL announced a decision in January to offer a system for swapping modular batteries under the brand of Evogo through its wholly owned subsidiary Contemporary Amperex Energy Service Technology.

In June, the company started building a battery swapping station in Hefei, in the central Chinese province of Anhui. It plans to set up 30 and 20 stations in Amoy and Hefei, respectively, by the end of 2022.

CATL has yet to announce the number of stations it plans to open in the future. For now, it intends to provide the battery service in 10 cities.

A standard station takes up around 40 square meters of land and keeps 48 “chocolate” replacement lithium-ion battery packs, shaped like chocolate bars, each offering a driving range of around 200 kilometers. Users of CATL’s battery service are allowed to swap up to three packs per visit, and replacing a pack takes about a minute.

To use the Evogo service, electric vehicles should be configured to hold chocolate batteries; doing so does not require changes to their bodies.

While China FAW Group’s midsize sedan Bestune NAT is currently the only vehicle so designed, Aiways Automobile, an emerging automaker, plans to release the U5 sport utility vehicle as an Evogo-compatible car at the end of this year.

The battery packs are offered as a subscription model. In Amoy, the minimum monthly subscription is 399 yuan ($58.79) per pack. Users of the Evogo service also need to pay for the replacement of batteries, but CATL says the cost is about the same as a fast charging service. The subscription program keeps EV prices low.

CATL says chocolate batteries can be used in 80% of EV models currently available on the global market and all EVs to be released in the next three years. CATL is holding talks on business cooperation for a number of EV models, Chairman Robin Zeng said at an auto industry event in July, showing his confidence that Evogo-compatible vehicles will increase.

CATL aims to establish early hegemony in the market for batteries as a service. The decision to enter the market quickly was prompted by growing expectations that the service will be a solution to the shortage of charging infrastructure in China as a result of a steep increase in EV sales.

The number of EVs, plug-in hybrid cars and other new energy vehicles owned in China topped 10 million for the first time at the end of June, the Ministry of Public Security said. According to the China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA), there were 4 million vehicle charging stations at the end of June, a twofold increase from a year earlier.

But 60% of them are on private property such as homes, so there remains a shortage of stations for public use and it is not unusual for congestion to occur at charging facilities on highways during holiday seasons.

Pinning hopes on the service as a solution to the shortage of charging stations, the Chinese government has this year announced plans to work out standards for the service, while also promoting the establishment of battery stations. Local governments are mapping out targets for establishing stations, with the cities of Beijing, Shanghai, and Guangzhou aiming to build 300-400 each by 2025.

Nio, an emerging EV manufacturer, has already set up more than 1,000 battery swapping stations for exclusive use by its customers. Although there also are other companies operating such facilities, the numbers of stations and vehicles that can use them are still limited.

READ the latest Batteries News shaping the battery market

CATL aims for ‘battery as a service’ hegemony in China, GUANGZHOU, August 22, 2022