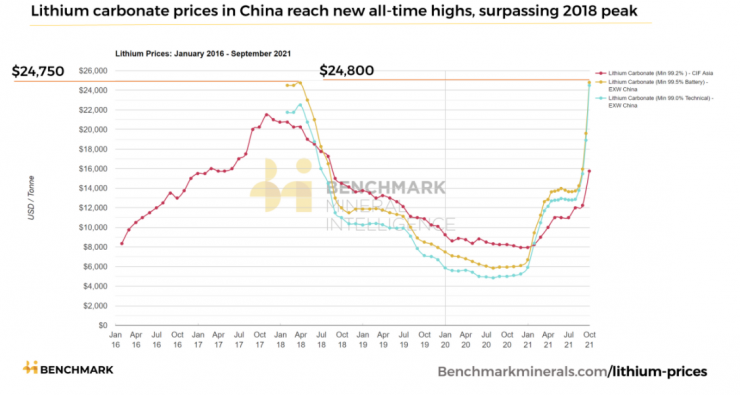

Benchmark – lithium carbonate prices reach new all-time highs.

Prices of lithium carbonate assessed by Benchmark Mineral Intelligence have reached new all-time highs on the back of limited supply and high and sustained lithium ion battery demand in China.

Benchmark’s EXW China (Battery) grade of lithium carbonate rose by 26.5% to RMB 160,000/tonne ($24,800) in the final two weeks of September 2021.

This surpasses the previous high of $24,750/tonne for battery grade lithium carbonate assessed on 30 March 2018, and marks a new era for the lithium industry.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

The highest end of Benchmark’s published range for our EXW China grade in September reached RMB 180,000/tonne ($27,900).

During the month, Benchmark’s EXW China (Technical) grade of lithium carbonate increased by 29.5%, marking some of the largest price jumps ever experienced in the lithium industry.

Looking forward, record high spot transactions are likely to incentivise a strong upward revision of contract prices in Q4 as new deals and pricing breaks are negotiated for the start of 2022.

Historically, supply contracts are negotiated in Q4 and can be influenced by sentiment in the spot market. It is this revision that sparked the surge in lithium chemicals pricing in 2015, indicating that the start of 2022 could see further momentum in price rises.

Market contacts have also reported to Benchmark that they expect a larger proportion of the supply chain may look to implement monthly, rather than quarterly, price breaks, fuelling the surge further if typically discounted contracted volumes become more regularly based on escalating spot deals.

Limited available supply within the domestic China market has served to push lithium carbonate prices to these new levels with lithium ion battery demand remaining high and steady after a year of significant growth.

Surging prices in the chemical market have not only been driven by tight supply and strong downstream demand, but also rapidly increasing feedstock costs as Benchmark’s Lithium Spodumene (FOB Australia) grade was assessed up 86% in September as lithium chemical converters scramble to secure available spot material.

While Benchmark’s EXW China hydroxide price has also seen unprecedented upward movement, rising by 68.4% over Q3 to an average of RMB 157,500/tonne ($24,425), robust demand for LFP chemistry cathodes in China has once again placed carbonate at a historically unusual price premium over hydroxide.

LITHIUM CARBONATE V HYDROXIDE, LFP’S ROLE

High-nickel cathode chemistries, which require lithium hydroxide, have not been deployed as quickly as expected, at the same time lower energy density, but cheaper, LFP cathodes have dominated the Chinese cell production industry in recent months.

Cells with LFP cathodes have held an average market share of 51.1% so far in 2021, compared to 42.6% in 2020, showing a step-change in demand as a result of technological improvements to the cathode chemistry and indirect policy support from the Chinese government for applications most suited to LFP.

Carbonate’s rare premium over hydroxide was also seen in Q1 and Q2 2021 in the Chinese domestic market, when carbonate price growth outpaced hydroxide on the back of fears over supply tightness.

Hydroxide narrowly regained its premium in late Q2 and into Q3 as additional seasonal carbonate supply from Chinese Qinghai Province brine producers provided some relief to upward carbonate price pressure, before the relationship again flipped at the end of September.

With newer Chinese conversion facilities now able to directly produce lithium hydroxide from spodumene feedstock, as well as having the flexibility to alternate production to favour the premium product, Benchmark expects the pricing relationship between the chemicals to exhibit more volatility in the future, dependent on demand dynamics.

Fundamentally, with little foreseeable downside price risk to carbonate or hydroxide pricing in the near term, as demand continues to outstrip raw material and chemical supply, the lithium industry is well and truly in the throes of its latest price rally, with further record prices expected in the coming months.

BENCHMARK’S LITHIUM CARBONATE PRICES REACH NEW ALL-TIME HIGHS, October 6, 2021