Battery recycling firms in South Korea plot abroad growth.

Some main South Korean battery recycling firms have made robust inventory market debuts as they aim abroad growth throughout a world scramble for EV metals.

Shares of SungEel HiTEch and rival Sebit Chem have greater than tripled since their listings in late July and early August, respectively. WCP, the nation’s second-largest battery separator maker, is scheduled to go public on the finish of this month with a Won432bn ($306mn) itemizing.

Recycling firms in South Korea, residence to 3 of the world’s 10 greatest battery makers — LG Energy Solution, shoppingmode Samsung SDI and SK On — have quick access to the scrap from battery cell manufacturing and clients to purchase the recycled materials.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

The firms are capitalising on a push from battery gamers world wide to cut back their reliance on China and different difficult nations comparable to Democratic Republic of Congo and Indonesia for key supplies.

Yoon Chang-bae, an analyst at KB Securities.

Battery recycling is becoming more important in terms of energy security as battery makers are keen to reduce their dependence on China in securing key materials.

Recycling firms have emerged as a uncommon vivid spot for buyers in South Korea’s sagging inventory market, as automakers speed up their transition in the direction of greener automobiles.

Yoon Hyuk-jin, an analyst at SK Securities, said:

Investors are betting on the growth potential of these ‘city mines’ as metal prices are surging again amid strong EV sales in China.

The choices of SungEel and Sebit have been oversubscribed, with their subscription charges beating that of LG Energy Solution, the world’s second-largest EV battery maker, which raised Won12.8tn ($9.8bn) within the nation’s largest IPO in January.

Founded in 2000, SungEel grew its recycling experience on a deluge of used moveable electronics to change into one of many world’s most superior collectors and processors of outdated and faulty lithium-ion batteries, which it now sources from the nation’s main automakers and battery makers.

The firm plans to triple capability by 2024 utilizing its IPO proceeds. It already has 9 recycling crops world wide — three in South Korea and the remainder in China, India, Malaysia and japanese Europe.

A SungEel govt said:

Demand for battery recycling is growing fast as [environmental, social and governance] becomes more important.

“We need to build a new plant this year to meet surging demand.”

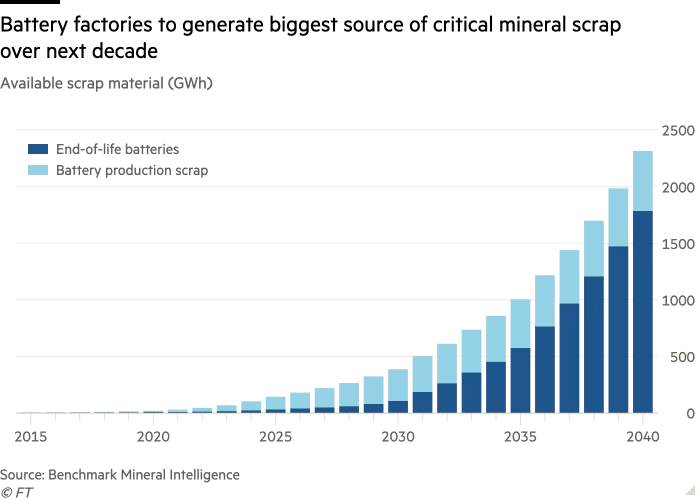

Battery recycling can ease potential provide shortages and reduce costs of vital metals comparable to nickel, cobalt, copper and lithium by reintroducing them into the battery provide chain, decreasing dependence on uncooked supplies from mines. Scrap for recycling can come from cell manufacturing and end-of-life batteries.

SNE Research forecasts the worldwide EV battery recycling market, which was estimated at simply Won400bn ($300mn) in 2020, to develop to Won21tn in 2030.

That anticipated progress is underpinned by the EU and US introducing highly effective legislative instruments to bolster recycling to safe provides of strategic minerals, as home mining initiatives stumble over allowing.

Korean battery makers are positioning themselves to learn from incentives contained in US president Joe Biden’s flagship financial package deal, often known as the Inflation Reduction Act, for native carmakers to decouple from Chinese provide chains.

Under the act, automakers obtain tax credit on EVs if a sure threshold of supplies is sourced from the US, free commerce companions or recycling. EVs with minerals and parts from international entities of concern might be not be eligible for these credit from 2025.

In July, SK On launched a $7.8bn three way partnership with Ford to construct three battery crops within the US.

In May, Hyundai introduced a $5.5bn funding to construct its first devoted EV plant and battery manufacturing facility within the US state of Georgia, whereas LG Energy Solution and GM introduced a $2.6bn funding earlier this yr to construct a 3rd plant as a part of their three way partnership in Michigan.

Analysts anticipate Korean battery recycling firms to step by step broaden their abroad presence to be nearer to the battery makers constructing crops within the west.

“Interest in recycling companies has surged as investors are concerned about battery metal sourcing since the IRA passage,” Yoon of SK Securities mentioned.

Korean recycling firms are competing with nascent western rivals comparable to Glencore-backed Li-Cycle, Redwood Materials, which was arrange by former Tesla chief technical officer JB Straubel, and Australia’s Neometals as they broaden their abroad presence.

Hans Eric Melin, managing director of Circular Energy Storage, a consultancy, mentioned the Koreans’ success lied of their shut relationships with the battery cell makers and their aggressive sourcing actions for waste to recycle.

SeungEel and Sebit are undervalued in comparison with western battery recycling upstarts, mentioned Melin.

Glencore-backed Li-Cycle has a market capitalisation above $1bn however made a $23mn ebitda loss within the third quarter because it scales up, in contrast with SungEel’s market cap of $1.2bn on 2021 working earnings of Won16.9bn.

“We have totally missed that a lot of material for a long time has mainly been processed in other countries, mainly Korea and China,” he mentioned. “All of the Americans and Europeans are far behind as SeungEel has processed batteries for recycling for over 10 years.”

Battery recycling firms in South Korea plot abroad growth, September 25, 2022