Advancements and Competition Key Factor Behind IDTechEx’s US$380 Billion Li-ion Forecast.

IDTechEx forecast the market for lithium-ion (Li-ion) battery cells to be worth US$380 billion by 2034, driven by advancements in technology and rapidly growing demand. While Li-ion batteries have been the dominant technology for electronic devices, electric vehicles (EV), and stationary energy storage systems, alternative battery technologies and chemistries continue to garner interest. For example, over the past four years, sodium-ion (Na-ion) batteries have emerged as a competitor, poised to capture market share amid concerns over cost and material supply. Additionally, various other battery chemistries, including redox flow, metal-air, and thermal energy storage technologies, are being explored for stationary and industrial energy storage applications. However, despite the emergence of alternatives, Li-ion chemistries are expected to maintain their dominance, fuelled by ongoing advancements that enhance performance and drive down costs. IDTechEx’s latest report, “Advanced Li-ion Battery Technologies 2024-2034: Technologies, Players, Forecasts“, analyses the range of technological innovations and advancements being developed for the next-generation of Li-ion batteries.

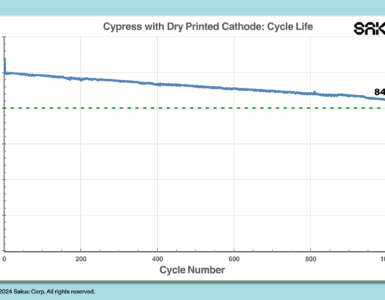

Key avenues for improving Li-ion performance stem from changes to the anode and cathode materials as well as optimizations in cell design, electrolyte formulation, changes in current collector design, and improvements to battery management systems. Energy density remains one of the most important performance characteristics as an enabler of longer range EVs, longer device runtimes, and for enabling new applications such as eVtol aircraft. With the current iteration of Li-ion designs reaching their energy density limits, there is considerable interest in anode materials like silicon and lithium-metal, which offer the potential for significant increases in lithium storage capacity and, therefore, energy density over batteries using graphite as the anode material. Beyond energy density, battery manufacturers and automotive OEMs are also increasingly focused on improving fast charge capability. Here, silicon-based anodes can also hold an advantage over graphite, with numerous companies advertising and starting to demonstrate the possibility of reaching 10-minute fast charge capability. These performance benefits will be useful not only for electric cars and vehicles but also for other applications, including consumer devices, power tools, drones, and military applications.

Solid-state batteries also continue to garner significant interest as one of the most promising next-generation battery technologies due to their ability for safer operation, an issue of increasing concern to the industry and consumers. Improvements to energy density are also possible with solid electrolyte technology as it can help enable the use of high-energy lithium metal anodes.

🔥 What about we co-host a webinar? Let's educate, captivate, and convert the battery economy!

Batteries News is the global go-to online magazine for the battery industry, we can help you host impactful webinars that become a global reference on your topic and are an evergreen source of leads. Click here to request more details

On the cathode front, efforts are focused on optimizing the balance between performance and cost. For example, materials such as lithium manganese iron phosphate (LMFP) and lithium-manganese-rich (Li-Mn-rich) layered oxides are being developed to bridge the gap between lower-cost LFP and higher-energy, high-nickel NMC and NCA cathode materials. Innovations to how cathode active materials (CAM) are synthesized are also being explored to reduce cell costs and minimize the environmental impact of cathode and battery production, issues that will only become more important. Barriers still exist before the widespread deployment of advanced anode, cathode, and electrolyte materials, but improvements to battery technology will be key to enabling the mass adoption of EVs and opening up new applications and markets such as electric and eVtol aircraft.

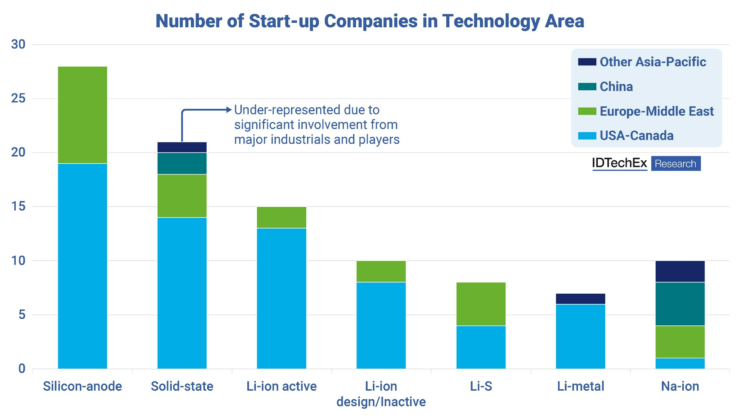

Meanwhile, the geographical dynamics of the Li-ion battery market are evolving. While Asia currently dominates the value chain, regions like the US and Europe are ramping up efforts to develop their own battery supply chains, leveraging innovation and next-generation technology development. The US is home to numerous startups dedicated to advancing and commercializing next-generation Li-ion technology. Government initiatives, such as the Inflation Reduction Act and funding provided by the Bipartisan Infrastructure Law, are further catalyzing innovation and investment. For example, companies like Sila Nano and Group14 Technologies are deploying available funding and investment to develop commercial-scale manufacturing capabilities for advanced silicon anode materials. While Asia remains a powerhouse in battery manufacturing and materials production, efforts in the US and Europe to cultivate domestic supply chains and foster innovation offer a pathway to competitiveness. The future of the Li-ion battery market will be shaped by ongoing technological advancements, geographical shifts in production, and the race to capture value in this rapidly expanding industry.

To find out more about the IDTechEx report “Advanced Li-ion Battery Technologies 2024-2034: Technologies, Players, Forecasts”, including downloadable sample pages, please visit www.IDTechEx.com/AdvLithium. IDTechEx’s latest report and subscription platform provides the data and analysis to keep up to date with the latest trends and innovations in battery technology.

READ the latest Batteries News shaping the battery market

Advancements and Competition Key Factor Behind IDTechEx’s US$380 Billion Li-ion Forecast. source